“Unlike some other calculations, those relating to poverty have no intrinsic value of their own. They exist only in order to help us make them disappear from the scene…. With imagination, faith and hope, we might succeed in wiping out the scourge of poverty even if we don’t agree on how to measure it.” Molly Orshansky

Background

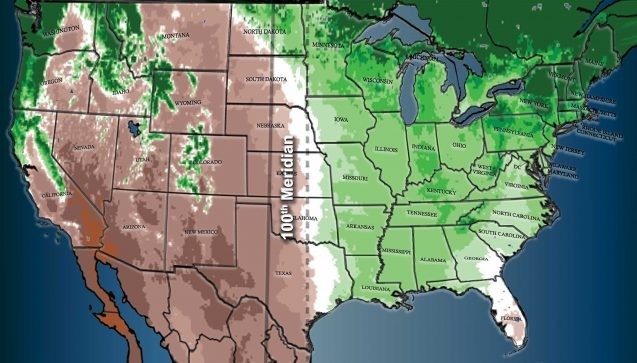

On February 07, 2023 President Biden outlined some of his Administration’s accomplishments, among them that 12 million new jobs (800,000 in the manufacturing sector, a small minority) were created over the last two years and that the unemployment rate has declined to 3.4%, a 50-year low. However, he omitted core underlying issues that threaten the nation’s economy and require immediate action: a high poverty rate, a yawning wealth gap, a chronic nationwide housing shortage, an ever-growing federal accumulated debt (the largest in the world), an unsustainable trade deficit, a high probability that the U.S. may become a net importer of food due to growing water scarcity west of the 98th meridian (the boundary between the “arid” west and the “humid east” has shifted about 140 miles east of the 100th meridian and now bisects the nation equally), the depletion of the Ogallala, Arizona, and California aquifers, and the catastrophic consequences we’ll all face when the petrodollar ceases to be the dominant reserve currency of the world. In all fairness, he’s not the only president that has not publicly addressed these issues, however sooner or later he or his successors will have to do so.

Poverty Thresholds

The poverty thresholds were originally developed in 1963 and 1964 by Mollie Orshansky, an economist working for the Social Security Administration (SSA). As she later indicated, her original purpose was not to introduce a new general measure of poverty; rather, she tried to develop a measure to assess the differentials in opportunity among different demographic groups of families with children. Her work was tweaked over the years; in 1992 the National Research Council’s Committee on National Statistics appointed a Panel, at the request of a Congressional committee, to conduct a study for a possible revision of the poverty measure.

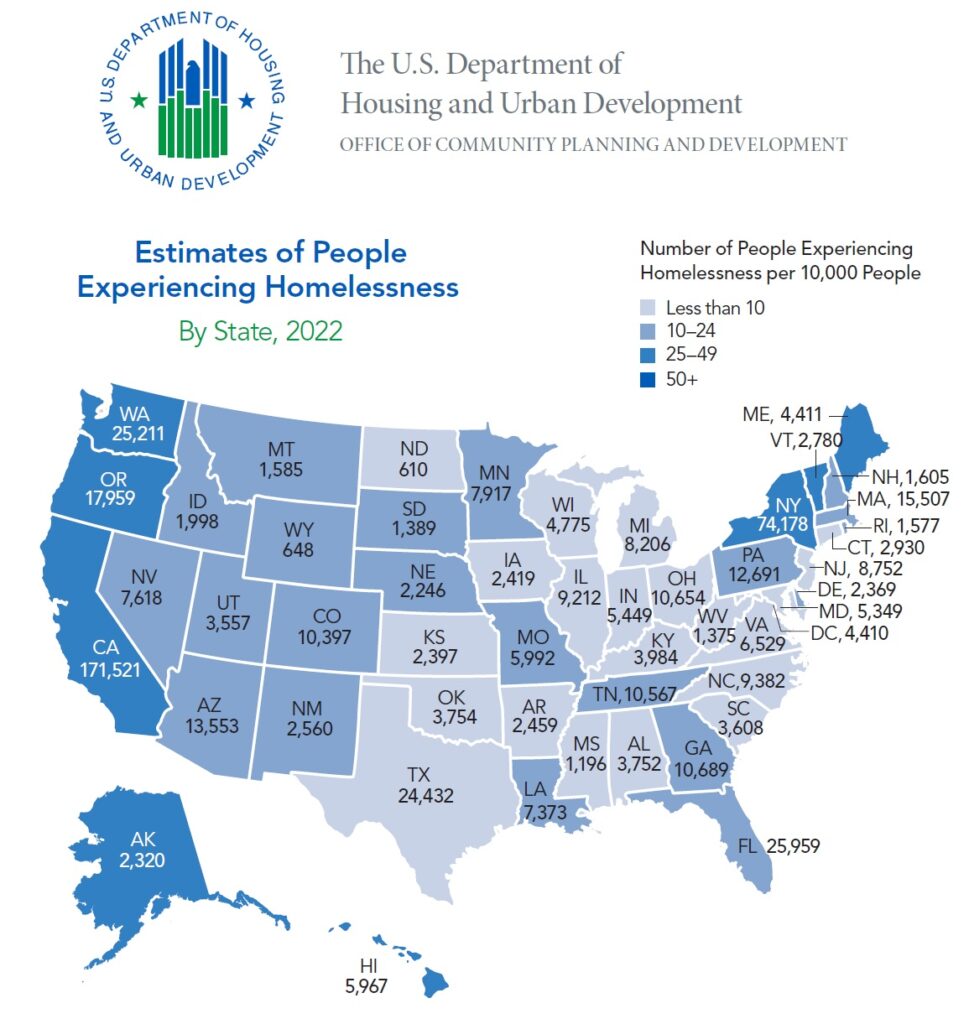

Poverty has many levels and types, and while related to extreme inequality, it is not congruent with it. For example, the economic deprivation of three separate persons earning $500 per year below, at, or above the officially recognized poverty threshold for a single individual would, for all practical purposes, be equally dire. Yet, the one who exceeds it might not qualify for public assistance including subsidized housing, food, in-home long-term care, medical care, or transportation. Unsurprisingly, some extremely poor or homeless persons intentionally commit crimes because for them, jail is a step up.

Poverty, like wealth, can be inherited. At least one study has found that career earnings premium from a four-year college degree (relative to a high school diploma) for persons from low-income backgrounds is considerably less than it is for those from higher-income backgrounds.

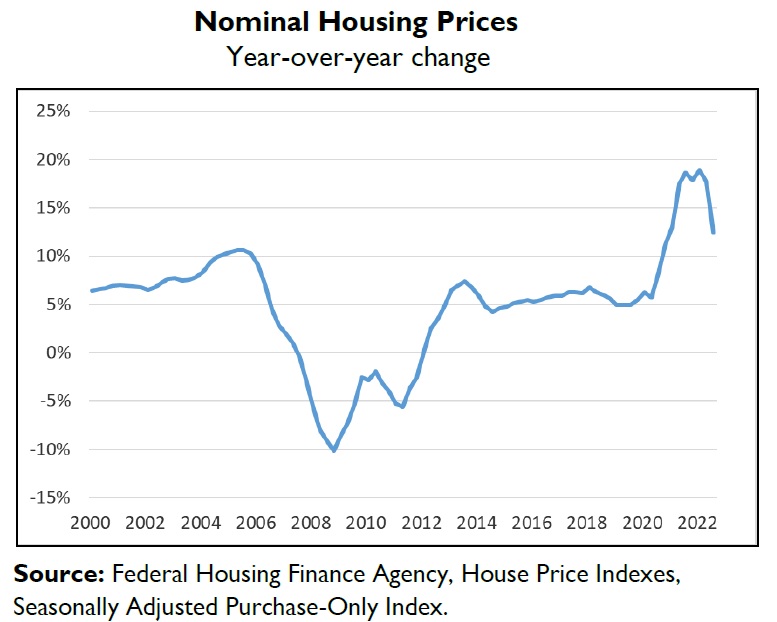

Economic, political, social, and even foreign policy issues are interconnected. However, though the working classes contribute the indispensable labor that supports the economy, the arbitrary and obsolete method the government uses to determine who is and who is not poor ignores two crucial criteria: (a) the static, growing inability of single individuals earning no more than state median incomes to purchase single-family dwellings, and (b) the growing gap in the distribution of wealth. In the 1950s the economy grew by 37%; high school graduates and 15 million returning GIs could expect to get a lifetime job without a college degree in manufacturing, buy a house and a car, and raise a family with two kids –on one income. In contrast, as of 2022 fewer than 9% of jobs are in manufacturing, and there is a glaring mismatch between today’s virtually non-existent job security, growing consumer and student debt, and a 30-year mortgage. Clearly, by the President’s disclosure, 800,000 new manufacturing jobs, or 6.7% of all the new jobs created, are not going to restore the happy stasis of the 1950s.

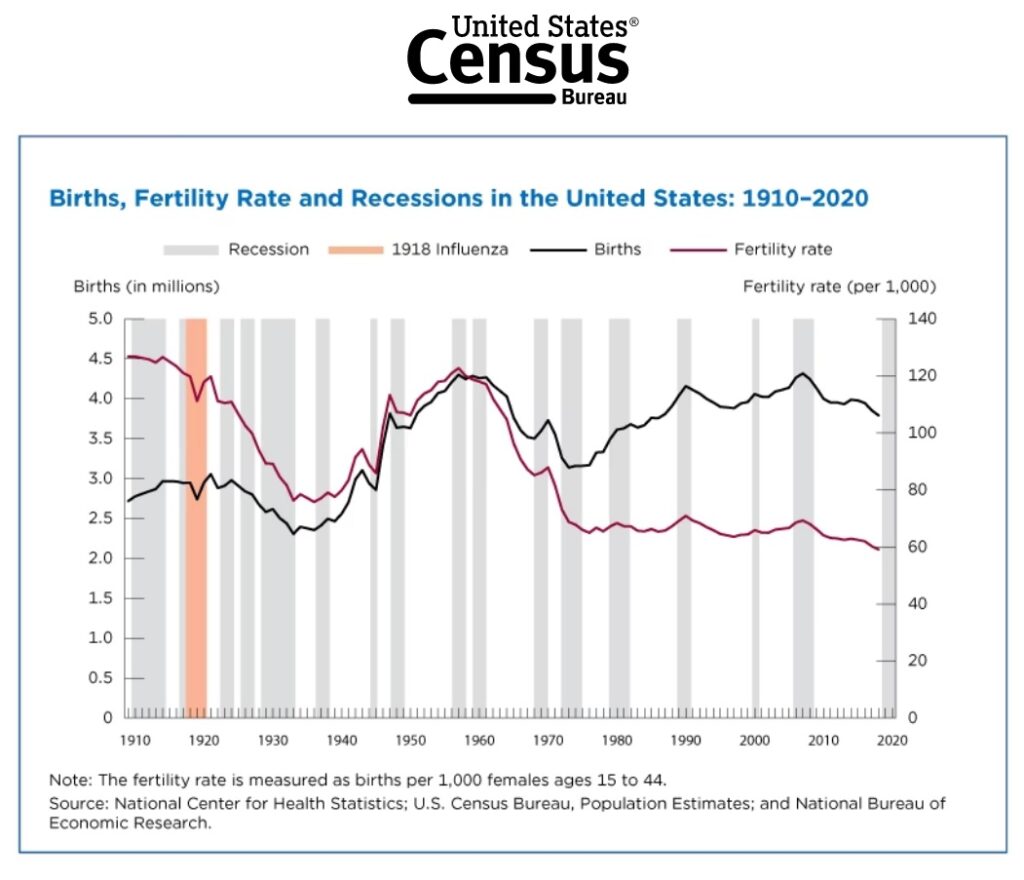

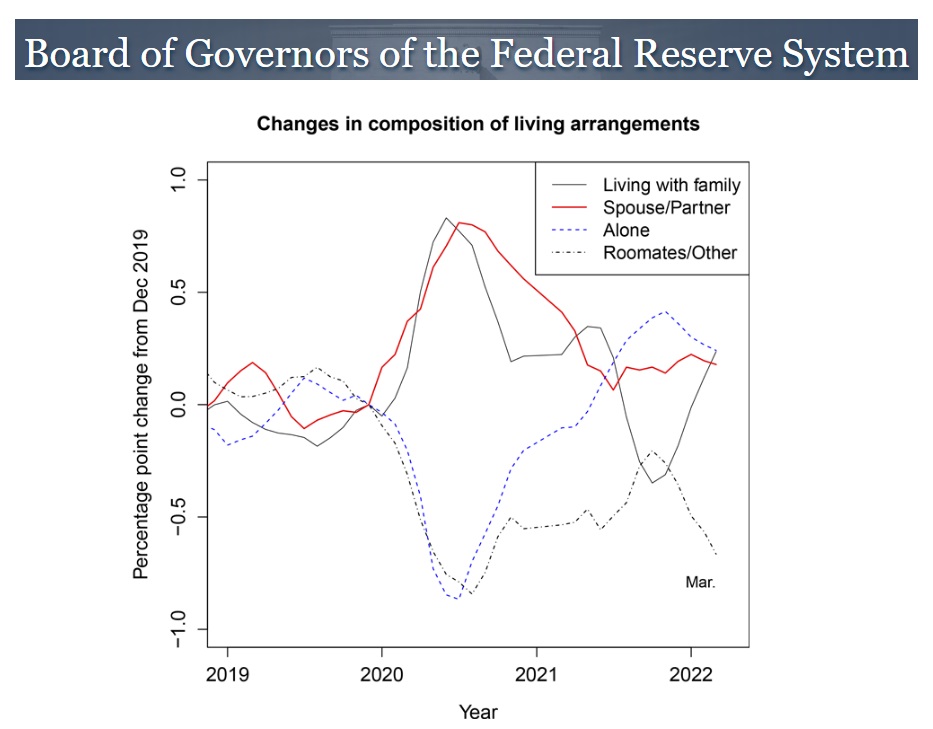

For all intents and purposes real estate resembles a giant (but legal) Ponzi scheme. Low home-building rates perpetually push prices ever higher. This illusion of wealth, based on ever increasing debt, masks the economy’s failure to reward the working classes with upward mobility based on hard work and loyalty. Ever-increasing prices happen to protect lenders, GSEs (Government-Sponsored Enterprises) and investors from catastrophic foreclosure rates –and insolvency. But the system is stacked against single, young, working-class people. Even before they get their first job, they’re often saddled with enormous student loans –debt that cannot be discharged in bankruptcy- that effectively prevent them from qualifying for a mortgage. And this doesn’t even take into account additional debt for a car –a necessity in most parts of the country- or consumer debt. Thus, to qualify for a mortgage, first they must either find a mate in similar or better financial condition, risking early divorce or separation and foreclosure, or live with their parents indefinitely. Of course, these circumstances have many ramifications detrimental to the nation’s overall well-being, among them a declining birth rate, a rising mortality rate, and alarming drug addiction statistics. The wealthier classes have not been affected to the same extent. In the third quarter of 2022, 68 percent of the total wealth in the United States was owned by the top 10 percent of earners. In comparison, the lowest 50 percent of earners only owned 3.3 percent of the total wealth. This dangerous imbalance must be addressed and dealt with.

Tables 1 (1950) and 2 (2023), while simplified and not intended to dwell into full underwriting analyses, illustrate the difference between the two eras in terms of buying power of one-earner incomes relative to the median prices of single-family homes. This difference should be adopted as the immutable standard for measuring poverty: the premise that any single-earner whose income is insufficient and/or unstable to buy a single family home over thirty years is, in fact, poor. Using Table 2, only 15 states (out of 50) have median single-earner incomes high enough to qualify. In other words, individuals in 35 states who make no more than the single-earner median income are poor.

Whatever we have done has brought us to where we are. Accordingly, we cannot expect a different result if we continue doing the same thing. Worse, for the first time in our short history we are competing for the hearts and minds of the Global South with China, a country with a population four times larger and of at least equal (and growing) economic strength. The entire world is keenly aware of China’s track record of having lifted 800 million from poverty in 40 years. As a result, China is now either their largest or second largest trading partner and the yuan is rapidly making inroads in challenging the dollar’s perch as reserve currency of the world. Either we make drastic systemic changes to produce a different result, or we may sooner rather than later find ourselves staring into the bottomless abyss of irrelevance.

The rise of China should neither be cause for alarm nor push us into a Thucydides trap that annihilates the world. Indeed, India will also follow suit, and as they continue to grow, they will concurrently demand energy and water on an unprecedented scale. Accordingly, the world should consider designing and gradually adopting a new economic system that reduces inequality within and among nations and simultaneously satisfies everyone’s minimum energy and water needs. This could be done not by confiscating existing property or laying onerous taxes but by distributing future wealth using a neutral global reserve currency (Special Drawing Rights might do) based on the production or use of green hydrogen on a per capita basis plus other economic activity. For example, a minuscule, sparsely populated but sun-drenched island nation whose economy has heretofore relied on fishing and tourism could build a solar-powered plant to produce green hydrogen by electrolysis of seawater. That would qualify it to have far more SDRs allocated to it, and since seawater and solar energy are for practical purposes inexhaustible, the island would have a strong incentive to produce as much hydrogen as possible. How it would allocate the new income among its people to reduce domestic inequality and poverty would be up to its government. The same principle would apply to large nations. The U.S., which has lost its manufacturing base, could make up for it by investing in a vast number of hydrogen-producing plants as outlined here. This is the wave of the future. In fact, China has already broken ground on the world’s largest green hydrogen plant. In contrast, despite the immense advantage of having a western (Pacific) ocean in close proximity to Death Valley, which could be converted into the world’s largest green hydrogen producing hub, the U.S. is paralyzed by a multitude of competing bureaucratic fiefdoms. Not only does this prevent taking emergency action to combat climate change and water scarcity west of the 98th meridian, every day of inaction sets us further behind.