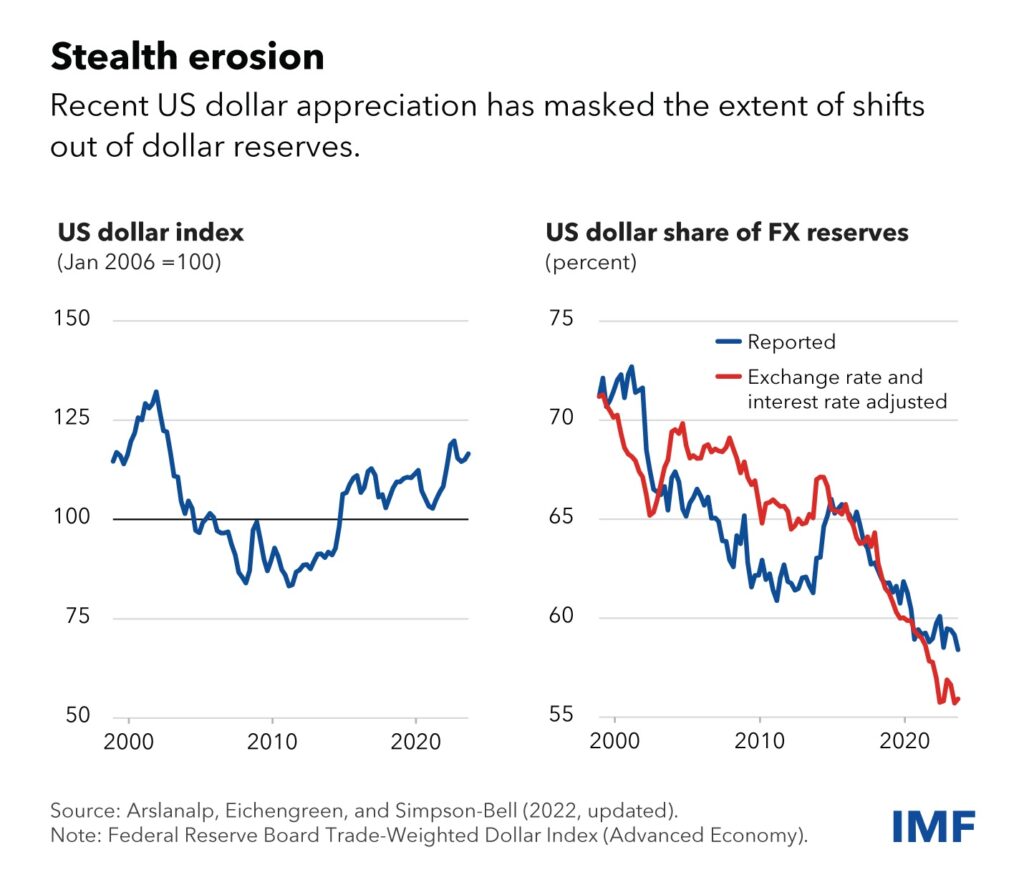

According to the International Monetary Fund (IMF), the U.S. dollar share of global foreign exchange reserves declined from roughly 73% in 2000 to about 56% in 2022 despite the dollar’s continued appreciation during that period. Particularly noteworthy is the slope of the decline beginning in 2014, the year of the Ukrainian Revolution but prior to the Russian invasion and the subsequent sanctions against Russia from the U.S. and its allies. Importantly, the figures do not quantify the recent and projected expansion of BRICS, their shared goal to drop the dollar in international transactions, and the growing tensions between the U.S. and China over Taiwan and the South China Sea.

The reason for the apparent paradox of the dollar’s appreciation and its declining FX reserve status is that since 1974 the dollar has in effect been backed by oil. No other currency has enjoyed that privilege.