When it comes to Sino-American relations, few westerners have the knowledge, understanding and experience of former Secretary of State Dr. Henry Kissinger. Speaking at the National Committee on U.S. China Relations Gala Dinner on November 14, 2019, he explained:

• The (U.S.) relationship with China started because both felt threatened by the Soviet Union.

• The U.S. and China have different and unrelated histories and cultures.

• The U.S. believes that solutions to problems bring about permanent stability; in contrast, the Chinese believe that no problem ever gets finally solved, and that every solution is an entry ticket to a new set of problems.

• They view each other as adversaries rather than potential partners.

• At the moment neither country can dominate the other, a new experience for two nations who think of themselves as exceptional.

• This is the first time in recorded history that two economic superpowers (the Soviet Union was never an economic peer of the U.S.) are competing economically, politically, culturally, technologically and militarily on a global scale, a prerequisite for a dangerous state of permanent conflict between their core interests.

• Modern economics and technology link the world into one system. Its collapse would be catastrophic for everyone.

• If both countries view their competition as a confrontation with the conviction that one side can achieve a permanent victory over the other, then the result would be catastrophic, worse than the two world wars combined.

• In addition to the Chinese challenge, the U.S. has assumed responsibilities in peacetime for many regions and problems throughout the world.

• He believes that people like him have a duty to work for a relationship in which both countries can talk frankly to the other about the dangers they see and the opportunities before them, to create centers of decision near their presidents in which a Sino-American dialogue can take place on a permanent basis; neither can afford policies of mutual, reciprocal threats. He further thinks that this endeavor will be very difficult and that there will be disagreements on many issues.

The Time Factor

Doctor Kissinger is of course correct about all of the above, particularly in that neither country can presently dominate the other. However, that equilibrium is transitory. The indisputable fact is that issues abound, among them the South China Sea, Taiwan, and North Korea, that could potentially elevate an already tense but, so far, peaceful competition to an all-out military confrontation. Under the circumstances, some American hawks might argue that the best chance to score a “permanent victory” over China is now. Conversely, keenly aware of that possibility, China’s counterparts might redouble their efforts to achieve, if they haven’t already, a state of mutually assured destruction on the extraordinary assumption that only that would effectively deter an American preemptive attack. So, unlike the Soviet Union, which never had an economy strong enough to withstand the arms race nor a population four times larger than the U.S., the stage is set for Doctor Kissinger’s dreaded and dangerous state of “permanent conflict” to set in.

Time on China’s Side

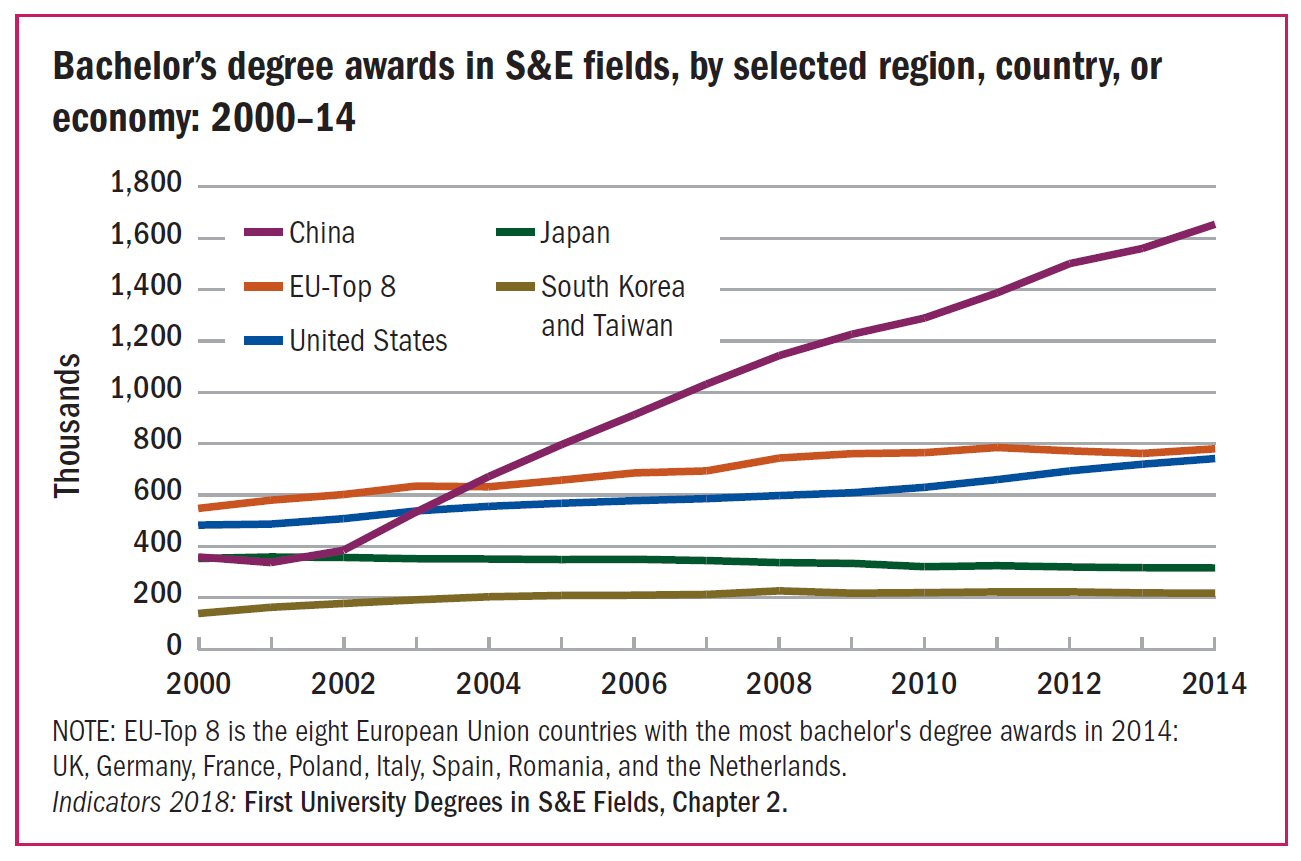

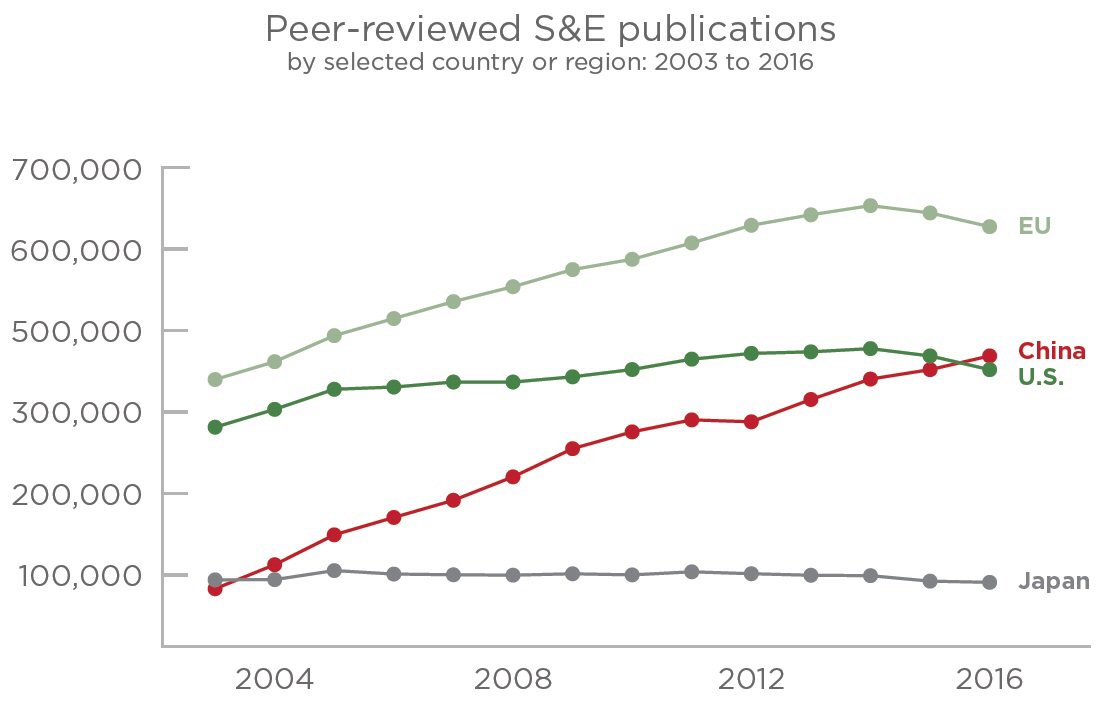

There are several reasons why China is on track to overtake the U.S. economically, and by extension, militarily. The first is that its all-powerful Communist Party can and does concentrate its resources where it sees fit; when a decision is made, it’s quickly executed. Secondly, but equally important, is that its economy does not depend on the yuan being the reserve currency of the world. Instead, it’s supported by its manufacturing prowess and the size of its growing domestic consumer base. As a result, China is now the first or second trading partner of almost every country in the world, including stalwart allies of the U.S., and its “one road one belt policy” is poised to magnify that position many fold. Thirdly, China’s sheer number of STEM graduates (4.7 million in 2016, according to the World Economic Forum) combined with America’s paltry 284,000 native-born STEM graduates means that the ratio is 16.5 to 1 in China’s favor. Inevitably then, barring necessary fundamental systemic and demographic changes in the U.S. that might allow it to remain competitive, it’s just a matter of time before China overtakes the U.S. intellectually. In fact, it’s already started. Today it has a commanding, overwhelming lead in the number of awarded bachelor’s degrees in science and engineering, and

in 2016 it passed the U.S. in the number of peer-reviewed science and engineering articles.

And China’s lead is not limited to STEM-related fields. It now makes advanced jet engines for military and civilian use, to the point that Germany, the country that first deployed jet fighters in World War II, has expressed interest in buying them. In addition, China is also at the forefront in reclaiming desert land (land restoration), cancer treatment, photovoltaic usage, and many other subjects.

Fourthly, as with everything else, the dollar’s role as the reserve currency of the world must necessarily come to an end. There are only two transitional choices: gradual and imperceptible, which might avoid economic shock, or, paralyzed by political necrosis, wait for the ax to fall.

Effect on Trade

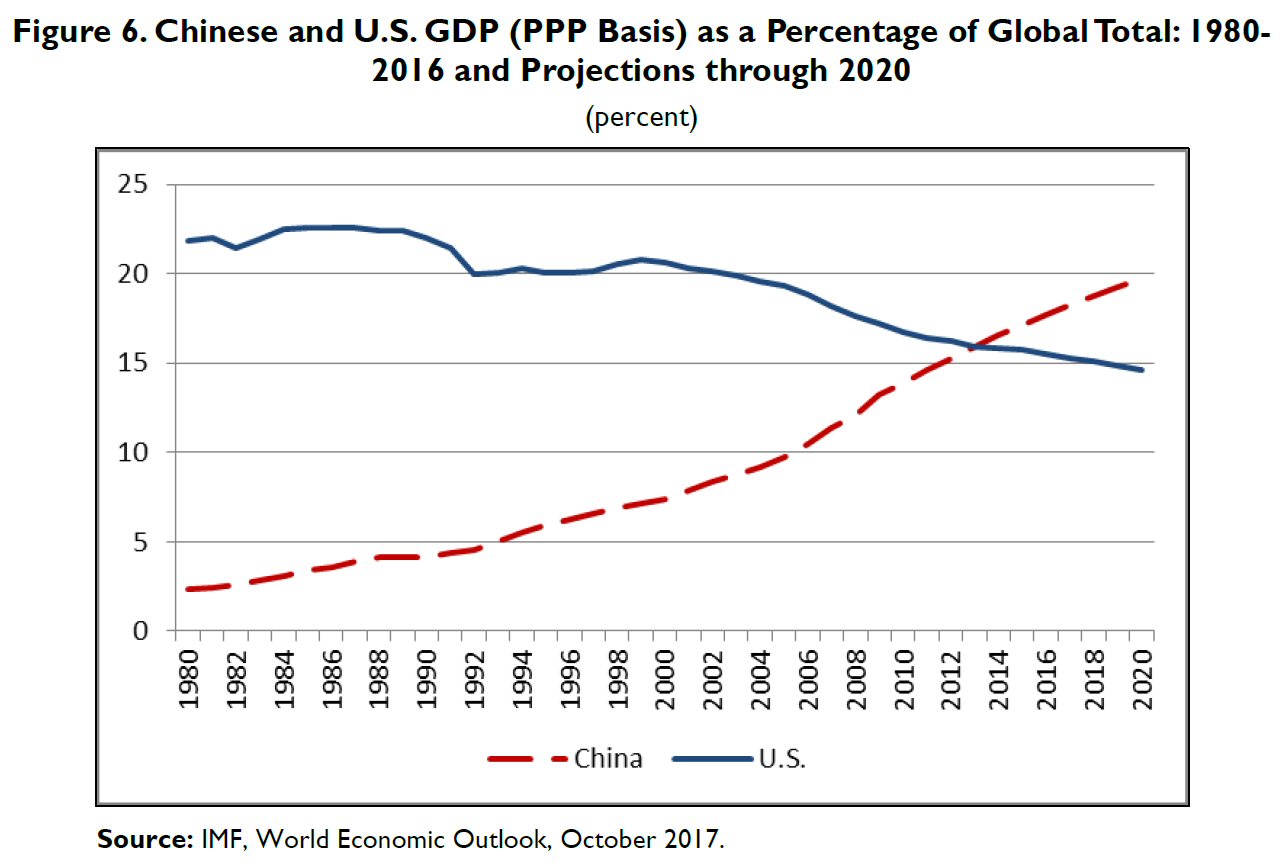

There is no doubt that the perennial fiscal and trade deficits of the U.S., are unsustainable. But tariffs, the equivalent of palliative care, are not a cure for the underlying ailment. It is beyond the scope of these few words to analyze our trade deficit with all the countries with which we have one. With respect to China, the much-celebrated trade truce of December 2019 whereby China agreed to purchase more agricultural products, particularly soy beans, in exchange for freezing tariffs on Chinese goods, is fatally flawed. Firstly, it fails to consider that, given the scope of its success in reclaiming desert land, China may eventually grow enough soy beans to meet domestic demand, and, if trends continue, it will soon also manufacture everything we excel at, but cheaper. This projection is based on its education performance and the fact that in terms of Purchasing Power Parity (PPP) its economy already passed the U.S.:

the same income buys a higher standard of living in China than in the United States. At that point, would it make sense for them to buy from us what they produce at a lower price, and conversely, won’t it make sense for our consumers to buy their (cheaper) goods?

Fatal Flaw

With bipartisan support, on December 9, 2019 the Congress’s Armed Services committees released a compromise bill that would authorize $738 billion in military spending in 2020. Meanwhile, the Congressional Budget Office (CBO) estimates that the federal budget deficit will average $1.2 trillion between 2020 and 2029. In other words, the accumulated deficit (currently over $22 trillion) will become $34 trillion by 2029. Accordingly, military spending in 2020 will account for 61.5% of the deficit. No telling what it will average between 2021 and 2029.

Clearly, Congress and the Pentagon assume that the country’s ability to spend beyond its means will not be curtailed by extraneous events and circumstances. In any event, no officials are publicly dwelling on the possibility that the dollar’s role as the reserve currency of the world may end in the coming decade and how that would impact the nation’s ability to borrow without triggering hyperinflation. At any rate, the lack of public debate on the subject is reminiscent of the proverbial ostriches sticking their heads in the sand.

The writing is on the wall. Germany, the largest economy in Europe and a key NATO ally, is presently not budging, despite strenuous American pressure, on its determination to complete the Nord stream 2 pipeline. It would increase Russia’s hard currency income, bypass and deprive the Ukraine from transit revenue, and directly supply Germany with Russian gas. Turkey, another nominal NATO ally, is also adamant about buying Russian S-400s despite express American objections and threats of sanctions. China, the world’s second-largest oil consumer (behind the U.S.), and the only other country with a (budding) oil exchange (priced in yuan), has agreed to expand oil purchases from Saudi Arabia. Unknown if the latter will agree to get paid in yuan. But the elephant in the room is that many countries will be phasing out fossil fuels to power their vehicles, and that includes China, the world’s largest auto market. Inevitably then, the demand for U.S. currency will collapse and the dollar will cease to be the reserve currency of the world. However, far from making provision for this day of reckoning, we persist on pursuing a doomed policy of global domination. Indeed, since 1776 the U.S. has been at war 93% of the time, which explains to a large extent our $22 trillion (and counting) debt.

Based on the above, a responsible solution to our fast-approaching predicament will require fundamental, permanent changes in our national philosophy and attitude, as well as a corresponding shift in spending allocations and priorities. Change is coming; our choice is to adapt to it either willingly or unwillingly. Hopefully we’ll choose the former.

Possible Solutions

The first is to become the world’s largest producer of hydrogen from electrolysis of sea water using solar energy exclusively, not just to become self-sufficient but to export it to China and India to help them phase out fossil fuels, eliminate the smog choking their cities, and make enough water to conquer drought. Simultaneously, that would greatly reduce our trade deficit, to the point that it might even flip it into a surplus.

The second would be to restructure all public utilities in all hydrogen-producing states. They would be relieved of their mandate to generate electricity; instead they would only maintain and service the distribution grid.

Third, all new and existing buildings in sun-drenched states would be outfitted with solar panels and batteries for night use. The electricity they generate would be pooled to satisfy domestic demand; the rest would be used to produce hydrogen. It would be distributed to domestic and foreign users, in that order. Property owners would be credited a prorated share of net income from sale of the hydrogen which would be automatically used to amortize their mortgages. That should spur new construction of affordable housing, and stimulate the economy.

Fourth, a global treaty should be entered into to make Special Drawing Rights (SPRs) the reserve currency of the world. Individual countries would earn them based on their production (landlocked countries may invest elsewhere) or consumption of green hydrogen on a per capita basis. This mechanism would create a global incentive to produce green hydrogen, wean the world from fossil fuels and nuclear fission, and give all countries, regardless of size and population, a pathway to supportable wealth.

Fifth, based on a more tranquil global environment, the U.S. defense budget would not have to be larger than the next seven nations combined. It could be reduced and the difference invested in badly needed infrastructure to make the country competitive in the global economy.

Sixth, a complementary temporary 15% tax on individuals exceeding $10 million net worth would enacted.