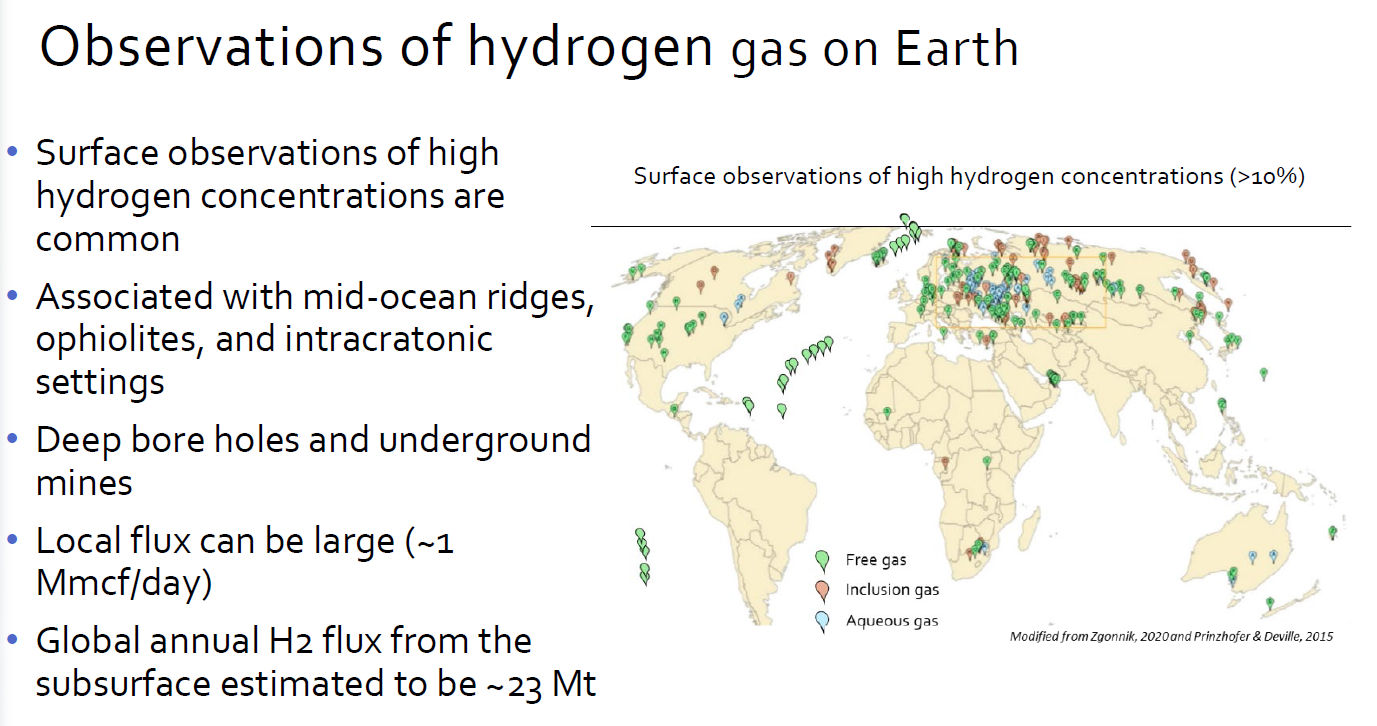

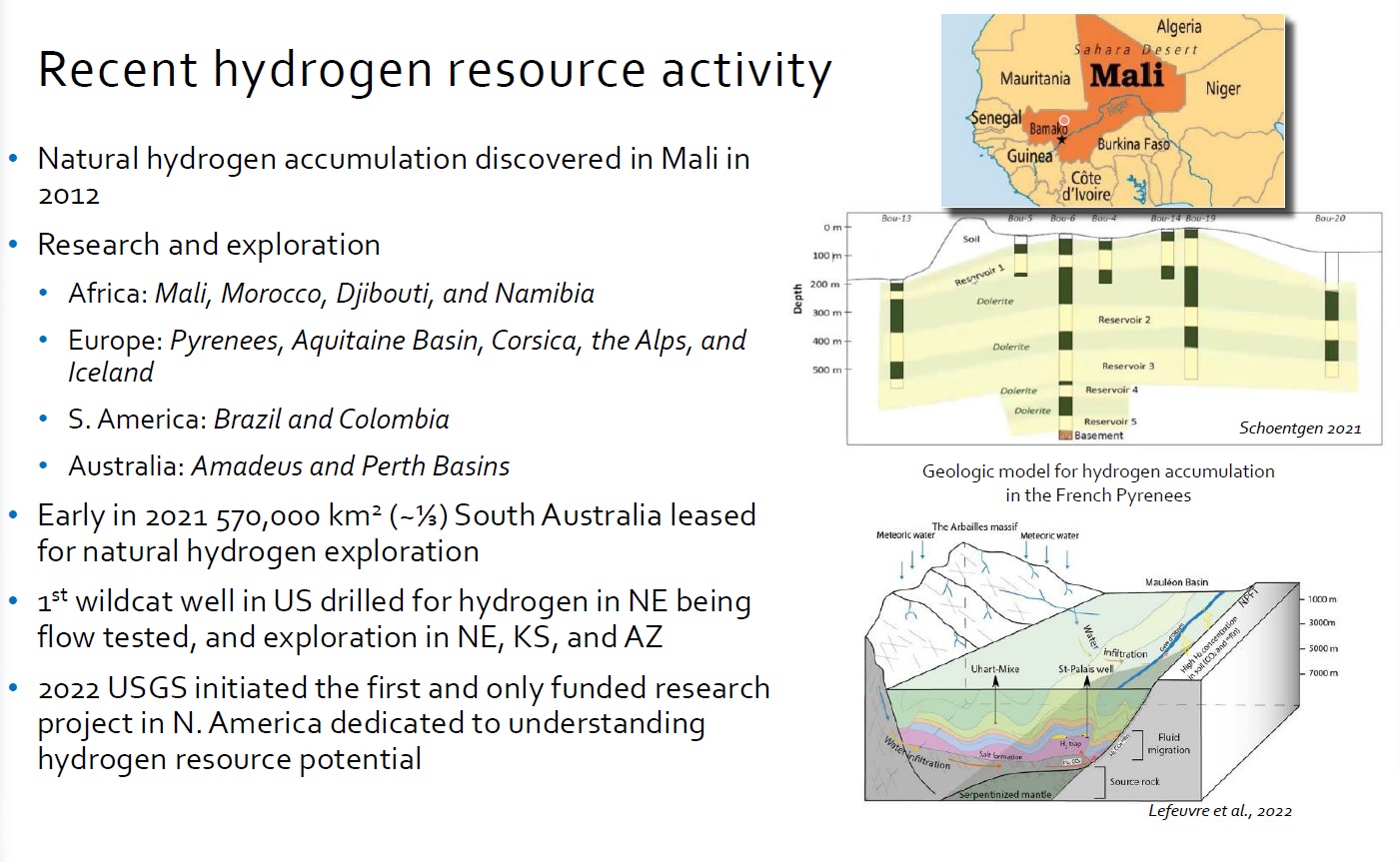

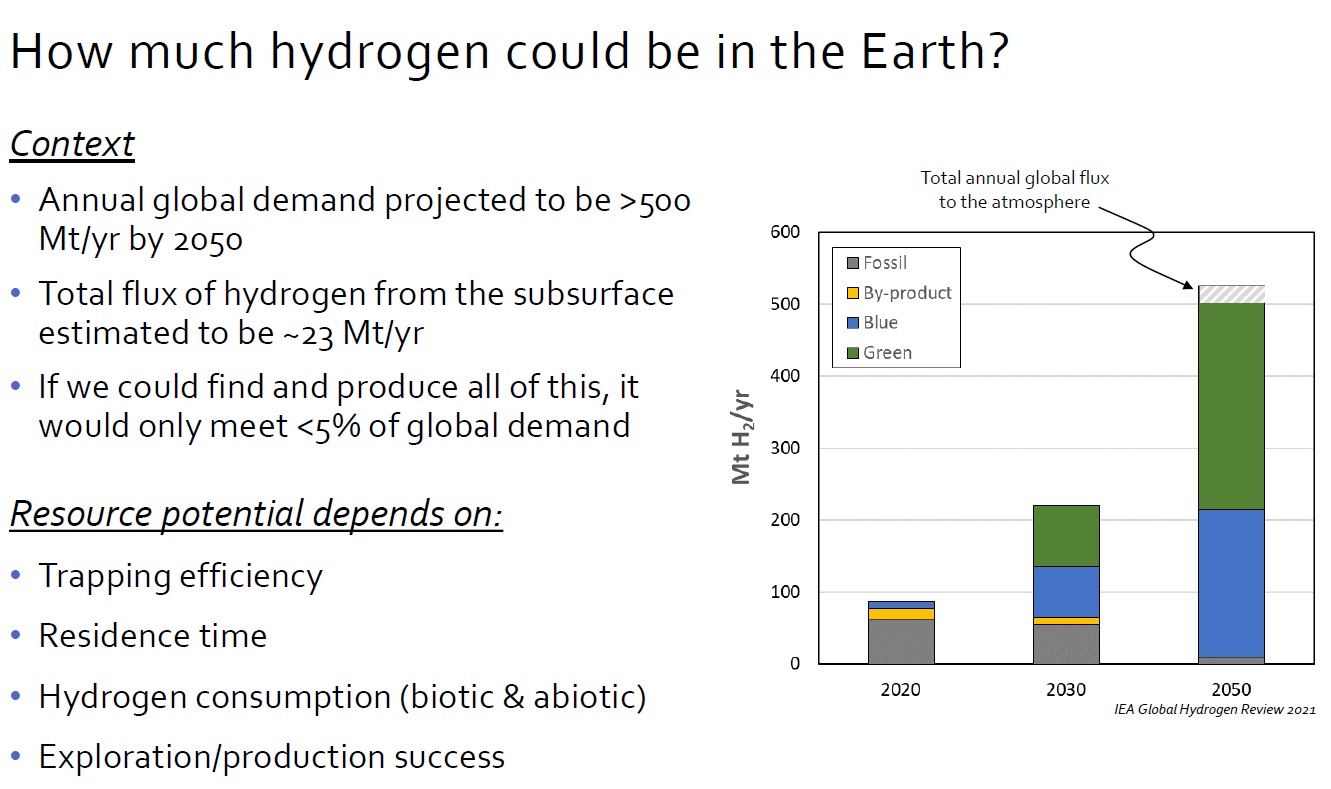

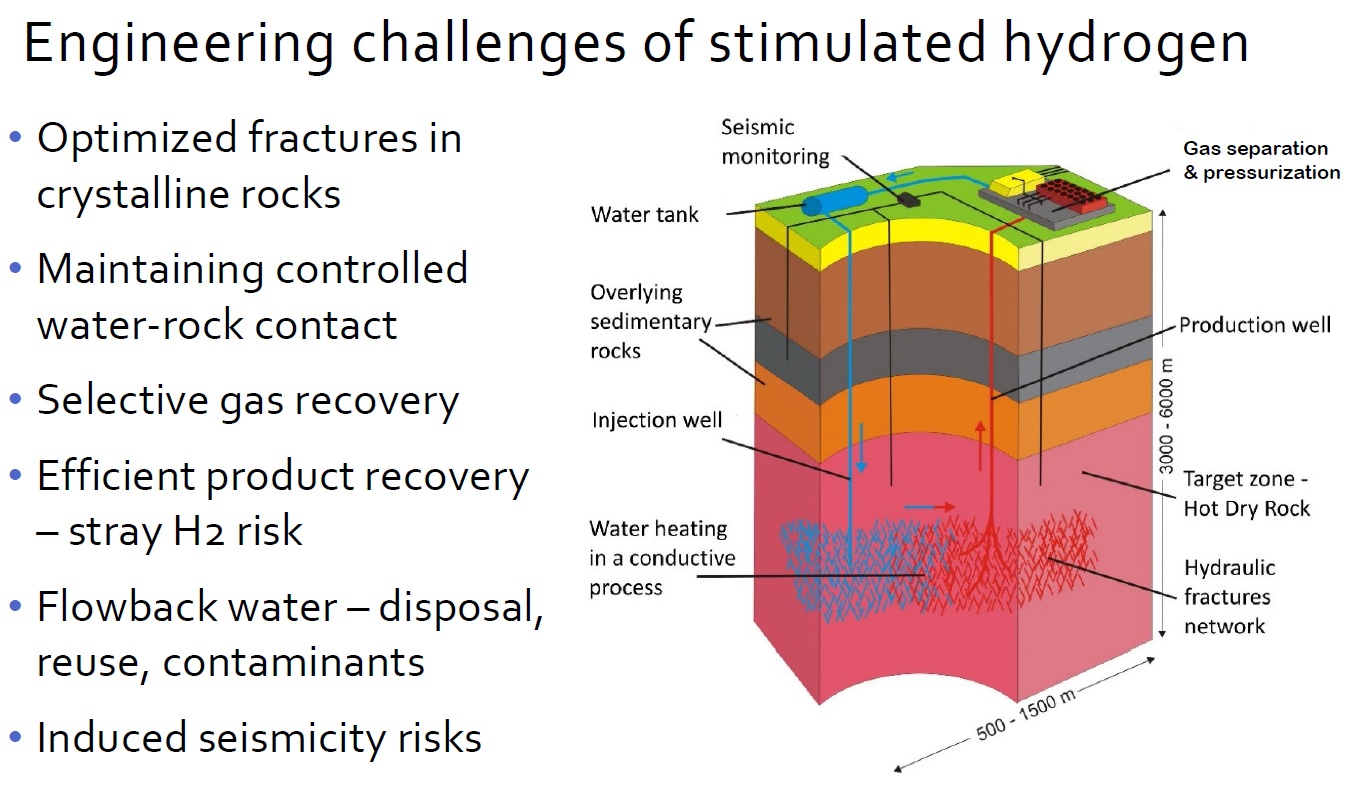

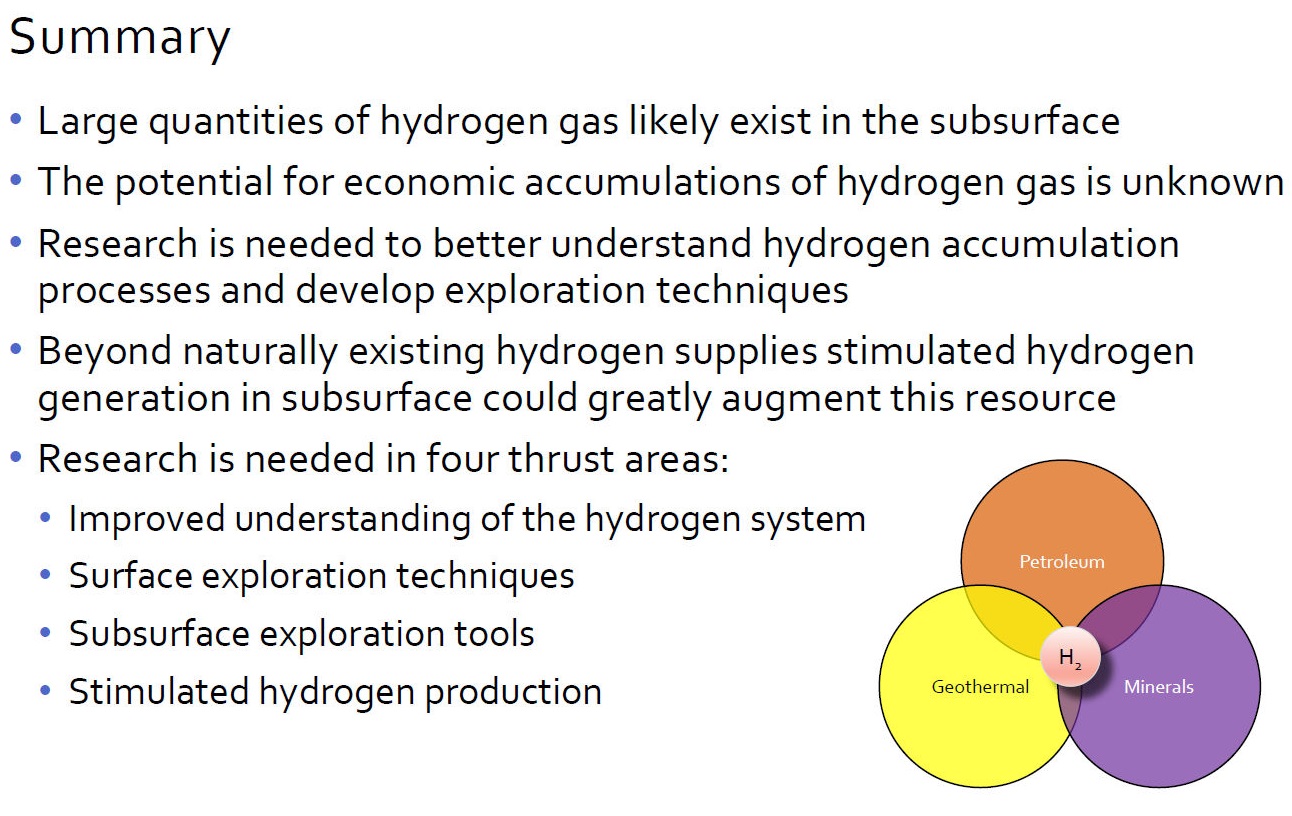

Existing Global Hydrogen Reserves

A U.S. Geological Survey has determined that substantial natural reserves of gas hydrogen exist throughout the world that could potentially meet global energy needs for several hundred years. Although some technological questions remain to be resolved, in view of global warming and its deleterious consequences, it seems a concerted coordinated global effort to develop this precious resource is long overdue.

Connecting the Dots : Water

December 7, 2024

Background

As we approach the end of the year, it is in right order to review a number of worrisome extant global issues. Though seemingly unrelated and disjointed, they are in fact interconnected pieces of an extraordinarily dangerous conundrum. As such, the following narrative is intended to recollect and reflect on how and why we got here.

Historical Aspects

The dissolution of the British, French, Italian and Japanese empires at the end of World War II ushered in a new world order. Although the U.S. and the Soviet Union emerged victorious from their common but separate struggles with Germany, in 1946, with most of the industrialized world in ruins, the U.S. accounted for 50% of the world’s GDP, held 80% of the world’s hard currency reserves, and was a net exporter of petroleum products. That new order rested on the strength of the U.S. dollar, America’s unmatched naval power, and its nuclear weapons monopoly. However, the demise of the British Empire had seismic political repercussions. In 1947 Britain’s cherished colony, India, won its independence and was promptly partitioned into Pakistan and India. That same year the United Nations General Assembly adopted Resolution 181, also known as the Partition Resolution, to divide Great Britain’s Palestinian mandate into separate Jewish and Arab states. On May 14, 1948, David Ben-Gurion, the head of the Jewish Agency, proclaimed the establishment of the State of Israel, and that same day President Truman of the United States recognized it. Then, on October 1, 1949, following a long and grueling civil war, the People’s Republic of China was established. The defeated Chinese Nationalists fled to Taiwan, prospered, and became a self-ruling virtual protectorate of the United States.

Nuclear Weapons

On 6 and 9 August 1945, respectively, the U.S. nuked Hiroshima and Nagasaki, and in so doing opened a Pandora’s Box of weapons of mass destruction. That monopoly lasted just over four years, until August 29, 1949, when the Soviet Union became the second country to independently design and explode a nuclear bomb. Subsequently Great Britain and France exploded their own nukes in 1952 and 1960 respectively, followed by China in 1964, India in 1974, and Pakistan in 1998. As for Israel, though it has never acknowledged – much less confirmed – how many nuclear devices it has, reputable whistle blowers revealed a thriving nuclear program. Independent experts believe it may have as many as 200 or more warheads with the ability to deliver them by aircraft, as submarine-launched cruise missiles, and via intermediate and intercontinental range ballistic missiles.

Soviet/Russian Economics

Although the Soviet Union was (and Russia remains) a nuclear superpower and a major exporter of fossil fuels, it never was, nor presently is, America’s economic peer. Case in point, at the end of the Cold War the Soviet Block accounted for just 10.5% of the world’s economy. As a result, though a latent overland threat to Europe, the Soviets never built a large fleet of nuclear-powered aircraft carriers nor acquired a network of naval bases throughout the Pacific with which to challenge the U.S.

Declining American Hegemony

Of America’s five hegemonic pillars of 1946, namely unmatched naval power, a nuclear monopoly, half of the world’s GDP, an unassailable dollar, abundant oil reserves, and net exports of crude oil, the only survivor is the dollar, and it is nowhere near as strong as it used to be. To be clear, while today the U.S. is a net exporter of petroleum products, it remains a net importer of crude oil. As for the dollar, two crucial reasons why the dollar retains its position as reserve currency of the world are Saudi Arabia’s 1970’s agreement to price oil in dollars and America’s ability to levy financial sanctions on practically anyone it wishes to. In contrast, in 1946 America’s incomparable manufacturing-centered economy, naval strength, and nuclear monopoly supported the dollar’s primacy. To be sure, some countries adamantly objected to that. French President Charles de Gaulle complained that the entire world labored to support a system that allowed the U.S. to print money with abandon, export some of its inflation, and spend beyond its means. Accordingly, he began exchanging excess dollars for American gold, an unsustainable trend for the U.S. Eventually that forced President Richard Nixon, on August 15, 1971, to close the gold window, end the dollar’s convertibility, and walk away from the Bretton-Woods agreement. Though many did not realize it then, that was the precise date when America’s dominance of the world economy ended.

The Rise of China

It’s an understatement to say that the complete economic and military hegemony that the U.S. enjoyed in 1948 has declined. As of October, 2024, China’s GDP (4.8%) is growing at a rate nearly twice the U.S. (2.8%), and in terms of PPP China’s economy is already on top. Unsurprisingly, since its costs are lower, that allows China to outbuild the U.S. As a result, China’s navy is now the world’s largest by number of ships, and the disparity is growing. What’s more, the quality of its ships and warplanes continues to improve, and they’re mostly deployed in the vicinity the protective umbrella of its considerable (and improving) coastal defenses. Rather, for the moment at least, it appears to be focused on denying the U.S. the ability to defend Taiwan. China is a potential adversary the likes of which the U.S. has never faced. In fact, the Preface to the 2023 Military and Security Report to Congress states, “The 2022 National Security Strategy states that the People’s Republic of China (PRC) is the only competitor to the United States with the intent and, increasingly, the capacity to reshape the international order” and identifies it as the “pacing challenge” for the Department of Defense.

Enter BRICS

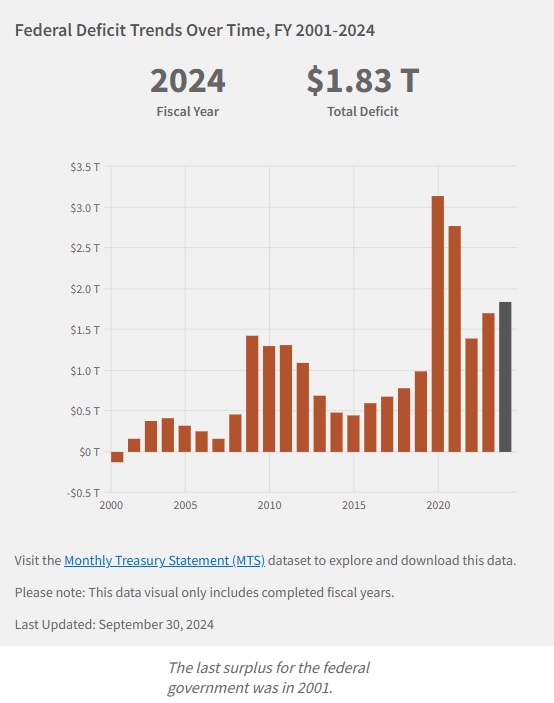

BRICS, a growing organization of emerging economies that collectively represents approximately 45% of the world’s population, is presently attempting to create a coordinated system to bypass the dollar for transactions among its members. Make no mistake. That is a direct threat to America’s ability to print money at will. While it’s too early to tell whether BRICS will succeed, the International Monetary Fund (IMF) has determined that the U.S. dollar’s share of global foreign exchange reserves declined from roughly 73% in 2000 to about 56% in 2022. And this happened before the BRICS de-dollarization drive. There’s also another complication. America’s formerly surplus economy has morphed into a $36 trillion (and counting) accumulated debt. To put that in perspective, interest on it now surpasses national defense and Medicare costs. In view of that heavy burden, the de-dollarization drive, the growing trade war and arms race with China, the critical Taiwan issue, and the extreme need for investment in America’s long-neglected internal infrastructure, it’s unclear if or how the U.S. will keep up with China’s buildup.

Multipolarity

It would be unrealistic to deny that today’s world is multipolar. While still substantial, America’s influence on world events faces stiff competition, and in some cases opposition, not just from China and Russia, but from up-and-coming India and the broader Global South as well. Already America’s Asian and Western European export-oriented allies simply cannot afford to shun the vast Chinese consumer market. Indeed, they have a powerful incentive to reach some pragmatic agreement akin to the recent breakthrough between India and China over their border dispute. In addition, it’s difficult, if not impossible, for anyone to guarantee the uninterrupted flow of fossil fuels from the Persian Gulf to East Asia through the Hormuz and Malacca chokepoints. As for the other two hotspots – Ukraine and Israel/Palestine – the fate of these conflicts, which are no longer unrelated, may ultimately hinge on the morphing military relationship between Russia and Iran.

The Iran/Ukraine Nexus

Unbeknownst to many at the time, the 1979 Iranian Revolution was a political event of seismic proportions. At that time the Warsaw Pact was still in force and Ukraine was an integral part of the Soviet Union. Today the USSR and its former alliance are both defunct. In their wake, NATO absorbed all ex-Warsaw Pact nations plus Finland and Norway. Thus, from Russia’s perspective, that has created a de facto front stretching from the Arctic to the Black Sea, longer than it was in 1941. Seeking formal allies, Russia found one in North Korea. Ostensibly they have defensive alliance that pledges each participant to come to the aid of the other in the event either one is attacked. Presumably then, Russia’s nuclear umbrella now extends to North Korea. In addition, China and Russia have conducted joint air/naval patrols near the Bering Strait and the East China Sea.

Russia-Iran ‘Comprehensive’ Treaty

As of this writing Russia and Iran also intend to sign a treaty that will include closer defense cooperation. Although its terms have not been disclosed, the circumstances and geography of this interaction differ substantially from the prior Soviet-Egyptian relationship. Firstly, a Russian-Iranian alliance would give them a credible potential ability to close the Strait of Hormuz, and by extension, prevent 20% of the world’s crude oil from getting to market. Needless to say, the consequences would be catastrophic. Secondly, the Volga River-Caspian Sea connection allows Russia and Iran to swiftly and relatively safely resupply each other. Thirdly, their incipient alliance is being cemented in the middle of the Ukrainian war. According to Western media, Iran has been providing Russia with drones which the latter has used in the war. If true, that’s aid from Iran to Russia, not the other way around. Accordingly, Iran likely expects something in return. This is markedly different from the preceding Soviet-Egyptian relationship because Egypt never provided anything indispensable to the Soviets. As a result, it lacked the necessary leverage to demand overwhelming offensive air power with which to defeat Israel.

Judea/Palestine: Before and After Roman Times

The name Palestine has its roots in Philistia, the Greek term for the land of the Philistines, who lived on the coast of what is now Israel and the Gaza Strip in the 12th Century BC. The Egyptians, Assyrians, and even Herodotus used a variation of Palestine. The Romans renamed their province of Judaea to Syria Palaestina and later to Palestine. In 135 AD the Jewish diaspora began. Emperor Hadrian defeated the Judean uprising, banned Jews from entering Jerusalem, which he renamed Aelia Capitolina, sold some captives into slavery, and dispersed others across the Roman Empire. In 629 AD, 153 years after the fall of the Western Roman Empire, Muslim armies Arabized the name to “Filastin” and ruled it continuously until the Ottoman Turks took control in 1516. In 1917, after defeating the Ottoman Empire during World War I, the British officially adopted the name Palestine and ruled their mandate for thirty years, until 1947. In all, the area was continuously known as Palestine for 1,812 years, and, but for a brief Christian Crusader interruption in the 12th century, Islam continuously dominated the region for 1318 years, from 629 AD to 1947.

Israel/Palestine: During and After the British Mandate

Resolution 181 called for the partition of the British Palestinian mandate into two separate Jewish and Arab states. However, Israel exists not because of Resolution 181, which never rose to the level of a binding Security Council resolution, but because of its victories in the War of Independence (1948-1949) and other conflicts over various Arab forces in 1956, 1967, 1973, 1982, 2006, and 2023 with the decisive and unwavering financial, military, diplomatic and political support of the United States. As a result, today Israel enjoys an overwhelming qualitative military superiority over all Arab states in the vicinity, even in the aggregate. While some might view these as separate individual wars, others, primarily some disaffected Palestinians, view them as one continuous open-ended struggle for liberation akin to the 774-year Spanish Reconquista (718-1492 AD).

The Soviet Union and Palestine

The Soviet Union never developed a military alliance with Egypt comparable to what the United States and Israel had – and have. Basically, the Soviets wanted military bases in Egypt with which to threaten the Suez Canal; but that relationship did not extend to a Soviet commitment to provide Egypt with offensive air power to annihilate Israel in support of the Palestinians. Instead, they sought to maintain a simmering defensive conflict between Israel and Egypt with which to make the latter perpetually dependent on Soviet aid. As a result, the Palestinian cause for statehood never had, even indirectly, as much military, financial, diplomatic and political support as what Israel had from the U.S.

The Case for Two States

Despite numerous binding UN Security Council resolutions calling for a two-state solution, it hasn’t happened. From 1967 to 1989 the Security Council adopted 131 such resolutions, including Resolution 242. On 10 June, 2024 Resolution 2735 passed with the United States voting in favor, reiterating once more support for a two-state solution. Instead, on 17 July, 2024 the Israeli Parliament (Knesset) voted overwhelmingly against Palestinian statehood. Then, on 12 November 2024 Israel’s finance minister ordered preparations for the formal annexation of settlements in the West Bank.

Security and Parity

Since the 1947 British withdrawal the Israelis have had to fend off numerous Arab/Palestinian attacks, and the underlying animosity between the two groups is, to put it mildly, remarkable. Understandably, Israel’s need to repel such attacks is undisputable. On the other hand, Israel’s overwhelming qualitative superiority also allows it to attack, at will, virtually anyone it wants. Accordingly, security is equally critical to the Palestinians. Therefore, it is not unreasonable for some among them to expect a two-state solution with eventual military parity, however likely that may be a non-starter for Israel. But similar situations are not unusual. How, for instance, would Russia react should Ukraine, tired of playing second fiddle to its much larger neighbor, insist on eventually achieving full military parity with Russia, which implies nuclear weapons, and irrevocably seek to enforce its sovereign right to join any alliance, including NATO? Similarly, what would the U.S. do if, flush with new riches, Mexico (pop 131,237,284), larger than Germany’s (84,385,745 as of Nov. 5, 2024), and over three times larger than Ukraine’s (37,860,221) should eventually surpass Germany, France and Great Britain in terms of qualitative and quantitative military capacity and decide to join a Chinese-led alliance?

Peace and Survival

It remains to be seen if peace based on the principle of parity is a feasible utopia or just a mirage. As things stand, the existing atmosphere of confrontation between the U.S. and its allies on the one hand, and BRICS on the other, may only expand and intensify the strategic cooperation between China and Russia and further degrade the concept of deterrence into an obsolete relic. To be clear, deterrence exists because there is no effective defense against a full-blown nuclear exchange between major powers like Russia and the U.S. Specifically, the Ground-Based Midcourse Defense system, supposedly America’s shield against a nuclear attack, is equipped with only forty-four interceptor missiles [Annie Jacobsen, Nuclear War, A Scenario (Penguin Random House LLC, 2024)] designed to hit fast-flying nuclear warheads travelling at speeds of approximately 14,000 miles per hour. In 2014 the U.S. Government Accountability Office reported that nine out of twenty hit-to-kill interceptor tests failed – meaning that it is approximately 55 percent effective. That won’t do. When compared with Russia’s thousands of warheads, the unavoidable conclusion is that the forty-four interceptors would be overwhelmed. In terms of commerce, which greatly influences relationships with both allies and adversaries, tariffs would improve market share of American-made products sold in the U.S., not in the European Union and the Global South. For that, American multinationals would have to relocate production to countries with lower labor costs. That, of course, has been tried before and it led to a crippling contraction of America’s manufacturing sector. In addition, protectionist policies could ultimately turn the World Trade Organization into just another obsolete relic and recreate the pre-World War I environment of captive markets. As we know, that did not end well.

In the Wake of Trafalgar

1805 saw two important battles Trafalgar (October 21st) and Austerlitz, also known as the Battle of the Three Emperors (December 2nd), both during the Napoleonic Wars. The latter confirmed Napoleon’s stellar generalship but did not establish a lasting peace in Europe. The former, a naval engagement between the British Navy and the combined French and Spanish fleets resulted in a decisive British victory that ushered in Anglo-Saxon naval supremacy for almost 220 years. It also caused the Spanish Empire to collapse, and with it, the flow of silver from the New World to Spain and to the rest of Europe. While at one time Japan appeared to be America’s naval peer, the reality was that the industrial capacity of the United States was orders of magnitude larger. In addition, Japan lacked – and lacks – domestic fossil fuel reserves with which to run its economy.

The Looming Threat

All-out nuclear war is genocide, and it cannot be won. In a letter to President Truman, Enrico Fermi and his colleague I. I. Rabi called the hydrogen bomb “an evil thing” [Annie Jacobsen, Nuclear War, A Scenario (Penguin Random House LLC, 2024)]. All countries, including the great powers, are basically defenseless against today’s hypersonic nuclear-tipped missiles. On November 17, 2024 President Biden authorized Ukraine to bomb Russia proper with U.S. weapons. On November 19th, Ukraine fired US-made longer-range missiles for the first time. That same day President Putin formally lowered the threshold for his country’s use of nuclear weapons. Then, on November 21st, in a televised address, he declared that the war was escalating towards a global conflict, and that in response, Russia had fired a new intermediate-range ballistic missile that travels at 10 times the speed of sound at a military-industrial facility in the central Ukrainian city of Dnipro. On November 23, the Russian press reported that France now allows Ukrainian strikes in Russia using SCALP/Storm Shadow cruise missiles with a range of 550km (390 miles). To put this in context, the distance from Shostka, Ukraine to Moscow is 511km (317 miles), or, in California terms, the distance from Los Angeles (LAX) to San Francisco (SFO) is 542km (337 miles). To keep the peace, the NATO and Russia rely on a contradiction in terms: that somehow having an arsenal of nuclear weapons will keep people safe from nuclear war. But in view of the creeping escalation of the Ukrainian conflict, the inescapable conclusion is that as of November, 2024, the concept of deterrence is on life support; it hasn’t died, but it’s on the brink. In fact, Secretary General of the United Nations Antonio Guterres has stated that we are ‘one miscalculation away from nuclear annihilation’, and the 2024 Doomsday Clock Statement of the Bulletin of the Atomic Scientists still shows 90 seconds to midnight.

Tariffs

President elect Trump promised hefty new tariffs on goods from Mexico, Canada and China. One unintended consequence is that they may harm US and European auto manufacturers, some from among America’s largest trading partners and allies. He’s also threatened 100% tariffs on BRICS members should they act to abandon or replace the dollar as the world’s reserve currency.

Ramifications of Tariffs

With respect to Mexico, tariffs amount to sanctions intended to force it to stop the flow of drugs and illegal immigrants into the U.S. In the event, it’s unclear if they would violate the free trade agreement with Mexico and Canada. Furthermore, tariffs are in effect federal sales taxes levied on American retailers who would probably simply pass them on to their customers – American consumers. Sales taxes are regressive. Therefore, when levied on ordinary consumer items, they disproportionately harm low-income people because by definition they must divert a larger percentage of their income to pay for them. In contrast, tariffs are mostly inconsequential to high income people. We’ve been through this before, and tariffs did much more harm than good. Between 1929 and 1934, when China was not a factor, protectionism ignited a 66% contraction of international trade. Today China is the largest manufacturing economy and a vital trading partner for most of the world. While tariffs might protect some American-made goods sold in the U.S., they would not help American multinationals improve or at least stabilize their market share in the global market. There are other factors at play. One hundred years ago the U.S. had a surplus economy. However, since 1971 it has had a history of virtually uninterrupted trade and fiscal deficits, international use of the U.S. dollar as a foreign exchange reserve has dramatically declined, and the nation is saddled with a (growing) $36 trillion accumulated debt. Under the circumstances, it’s difficult to say who would suffer the most – and blink first – should the world fall again into an uncontrollable spiral of protectionism. As for the dollar’s fate as reserve currency of the world, it should be determined by market forces, not geopolitical confrontations. Accordingly, sovereign nations ought to have the inalienable right, individually or in the aggregate, to choose which medium of exchange to use as such. Therefore, Mr. Trump’s intent to levy 100% tariffs on BRICS or other nations or groups thereof that abandon the dollar is likely to not be well received internationally. Case in point, Russia and Iran have already agreed to trade in local currencies instead of the U.S. dollar. It’s unclear how the European Union, China, India, and the other BRICS countries might react.

Defending the Dollar

Obviously Mr. Trump rightly recognizes the degree to which the American economy would be devastated should the dollar lose its status as reserve currency of the world. In the event, should key commodities, particularly oil, cease to be priced exclusively in dollars, it’s not inconceivable that at some point other countries might also refuse to accept dollars altogether. That would all but collapse its value – which in any case is presently not backed by any hard assets – and ignite hyperinflation on a scale reminiscent of the Weimar Republic, Zimbabwe, or Venezuela. Since the government is already saddled with a (growing) $36 trillion debt, and the consequent obligation to pay interest on it now exceeds than the entire defense budget, insolvency is not impossible. In that case, should its consequent ability to borrow be seriously compromised or even curtailed, it’s not clear how the government would continue to pay for Social Security, Medicare, and other entitlements that literally keep millions of voters alive.

Restoration

Mr. Trump’s slogan “Make America Great Again” is timely and well intended. However, there are several aspects about it that need to be analyzed. Firstly, it implies that America is no longer great, which is not entirely true. Few might deny that it has appreciably declined. But if it has, who (what is not an appropriate question to ask because someone is ultimately in charge) caused it? No one should make China a scapegoat. Not only is its meteoric growth well deserved, it’s unprecedented in history. That begs the question, if China was able to lift 800 million people from poverty in 40 years, why didn’t America meet or exceed that record in percentage terms? It’s not that there was no warning. During the 1992 debate with Bill Clinton and George H.W. Bush, Ross Perot assailed the North American Free Trade Agreement (NAFTA) which had just been tentatively agreed to by Canada, the U.S. and Mexico and subsequently went into effect on January 1, 1994. He said, “You implement that NAFTA, the Mexican trade agreement, where they pay people a dollar an hour, have no health care, no retirement, no pollution controls, and you’re going to hear a giant sucking sound of jobs being pulled out of this country.” The facts vindicated him. Between 2009 and 2017 global auto producers built 11 new assembly plants in North America, eight of them in Mexico. As a result, Mexican employment in the sector skyrocketed while the number of American autoworkers declined. Worse, from 2002 to 2013 real autoworker wages in the U.S. nose-dived 26%, and have largely stagnated since.

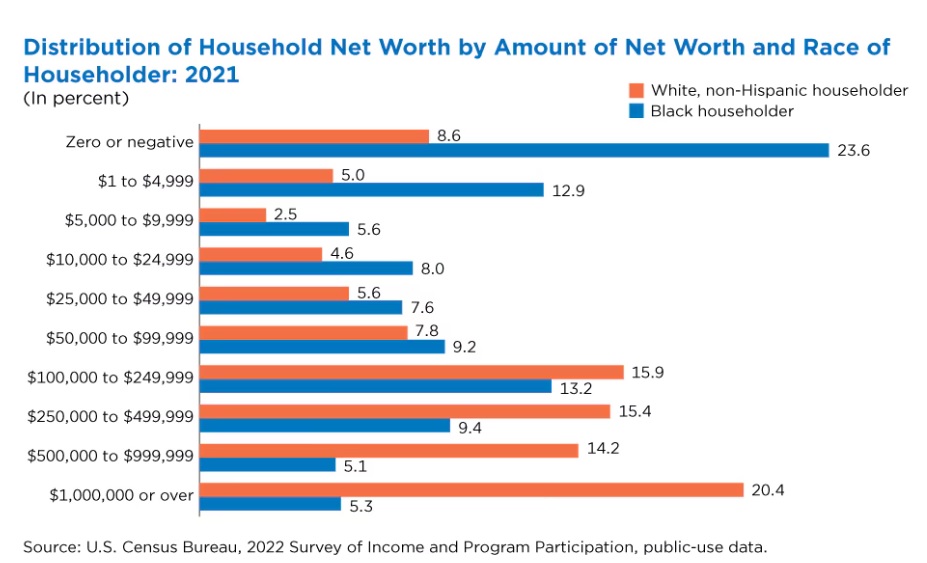

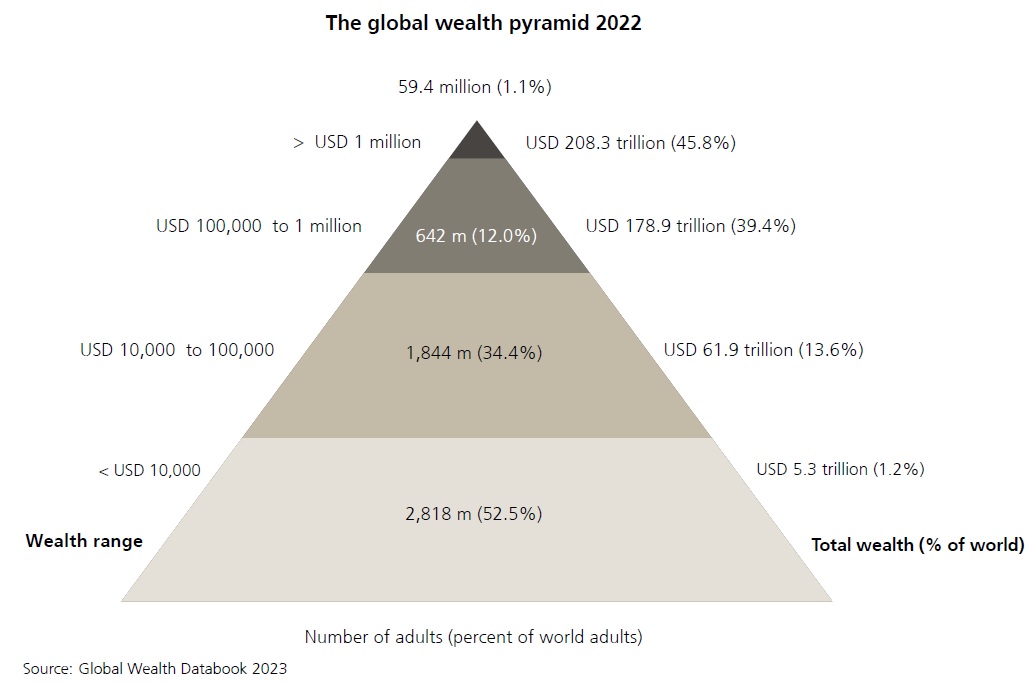

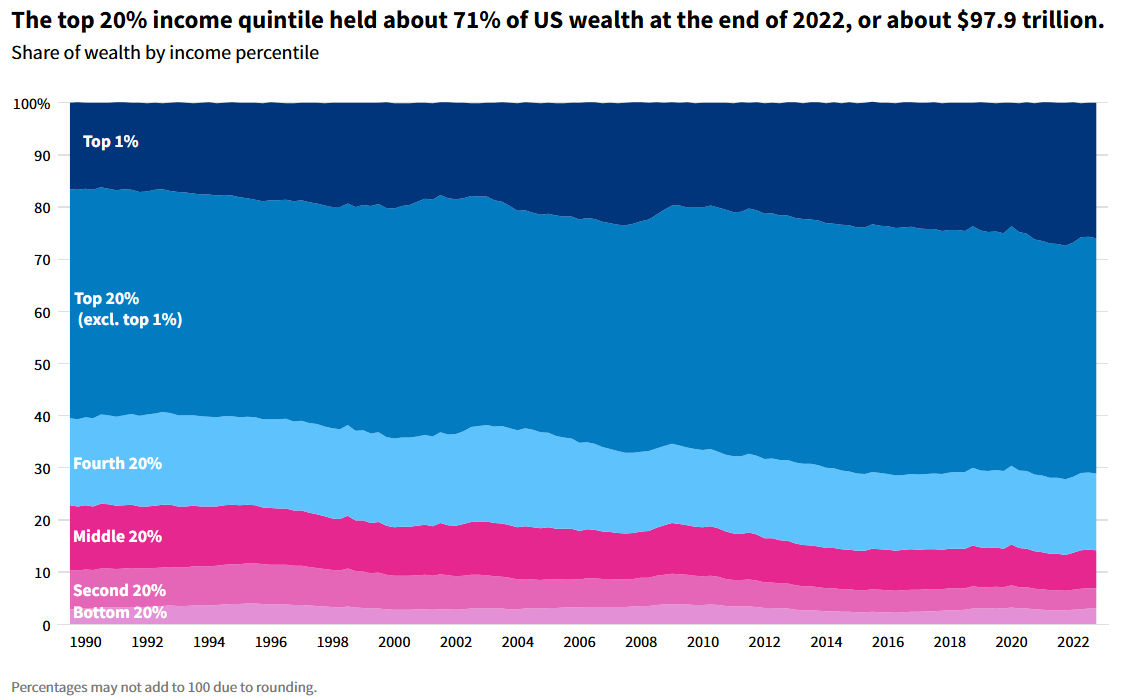

Distribution of Wealth

Perot’s prescient prediction turned out to be a defining moment. Over the past three decades the wealth held by the highest-earning 20% of Americans grew; in contrast, the wealth of those who earn less declined. Not only that, in terms of participation in the stock market, the richest 1% hold more than half of stock and less than 5% of debt; in addition, in 2021 households with a white, non-Hispanic householder were ten times wealthier than those with a Black householder. Accordingly, it can confidently be concluded that the great outsourcing that Perot warned us about benefitted the top 20% of the population and harmed the rest, particularly Black people. Globally, the group of high-net-worth individuals is increasingly dominant. Their aggregate wealth grew five-fold from US $41.4 trillion in 2000 to $208.3 trillion in 2022, and their share of global wealth rose from 35% to 46% over the same period. However, at the same time the group with wealth in the range of $10,000 to $100,000 has seen the biggest rise in numbers this century, more than trebling in size from 503 million in 2000 to 1.8 billion in mid-2022. This reflects the growing prosperity of emerging economies, especially China.

Methods

Though Mr. Trump is indisputably correct in his assessment that the dollar needs to be defended; but it will be crucial to go about it in a way that garners overwhelming support from that large segment of the world’s population whose economic condition stagnated or declined. America will need their cooperation, not opposition, to deal with Chinese competition. Sanctions and tariffs might achieve temporary results, but they can also have unintended consequences. Finally, U.S. voters will of course judge in upcoming mid-term elections whether their economic condition improved, stagnated, or declined.

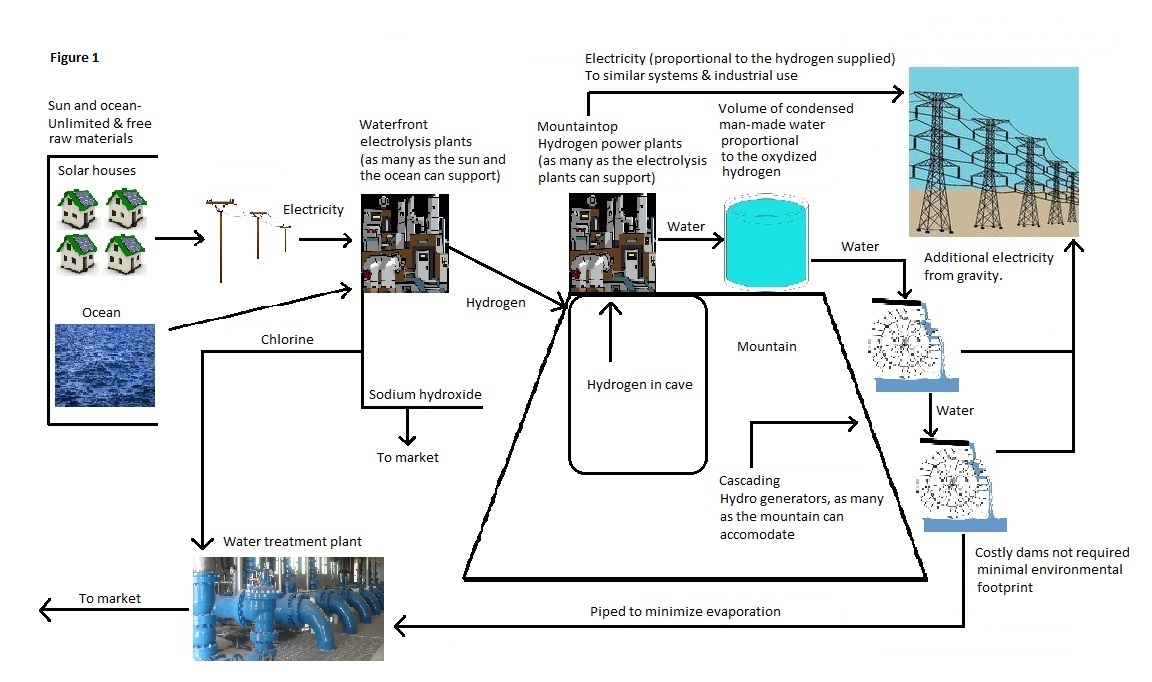

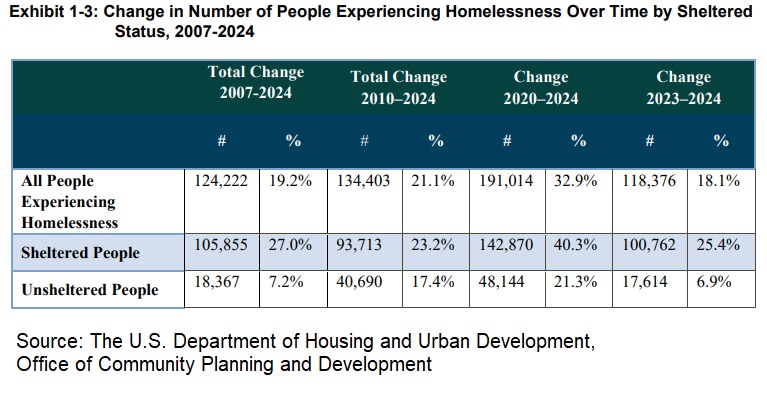

Earning Leadership

It is imperative to recognize and accept that leadership must be earned, not expected or demanded. Therefore, to compete with China’s undeniable results, America ought to consider a model based on and supported by aquafacture that equalizes the population density and gross domestic product (GDP) gap between eastern and western states, promotes a reasonable distribution of wealth and the elimination of extreme poverty within and among them, and creates avatar income for those who will inevitably be marginalized by artificial intelligence and robots. In addition, America must lead by example, not by reneguing on previous agreements that did meet expectations. No, this is not incompatible with capitalism, democracy, or any altruistic ideal. Instead, it envisions the all-encompassing solution of mass-producing green hydrogen from electrolysis of seawater using an innovative proprietary combination of solar, geothermal energy, and gravity to generate surplus electricity and pure water.

Green Hydrogen

The would-be project’s goals are:

- To replace fossil fuels currently being used to generate electricity with green hydrogen. Hydrogen is recyclable, easily and freely accessible in the ocean, can be exported by ship and pipelines, and has the distinct advantage of producing, as a byproduct, unlimited water. The system could be simultaneously used, among other things, to stop the desiccation of imperiled bodies of water such as the Dead Sea, mitigate the global depletion of aquifers and melting glaciers, fight expanding desertification, grow more food, keep the peace, and prevent mass migrations.

- Create a formula based on a per nation, per capita production of green hydrogen to automatically determine the exchange rate of all currencies. That would not violate anyone’s national sovereignty, would permanently prevent currency wars, and create a level playing field for all nations regardless of size of territory or population to improve their purchasing power.

- Following are: an overview of the plan, the available (and rapidly improving) technologies supporting it today, the rationale behind it, and its details.

What is not Required

The project does not require abandoning fossil fuels in the near term; rather, their use would continue in tandem with the green hydrogen project during the transition phase. In addition, it is not incompatible with the manufacture and use of electric vehicles unless at some point in the future the economics of hydrogen-powered vehicles prove to make sense.

Epilogue

The elevated danger of a nuclear holocaust that could ignite at any time and without warning, and the certain catastrophic losses that await us due to climate change have also created a doorway that can lead to a peaceful, prosperous life for all. Let’s not miss this once-in-a-lifetime opportunity and walk through it without hesitation.

Credit Suisse Global Wealth Pyramid 2022

A large base of low wealth holders underpins higher tiers occupied by progressively fewer adults. We estimate that 2.8 billion individuals – 53% of all adults in the world – had wealth below USD 10,000 in 2022. The next segment, covering those with wealth in the range of USD 10,000–100,000, has seen the biggest rise in numbers this century, more than trebling in size from 503 million in 2000 to 1.8 billion in mid-2022. This reflects the growing prosperity of emerging economies, especially China, and the expansion of the middle class in the developing world. The average wealth of this group is USD 33,573 or about 40% of the level of average wealth worldwide. Total assets of USD 61.9 trillion provide this segment with considerable economic leverage. The upper-middle segment, with wealth ranging from USD 100,000 to USD 1 million, has also trebled in size this century from 208 million to 642 million people. Members of this group currently own net assets totaling USD 178.9 trillion or 39.4% of global wealth, which is over three times their percentage share of the adult population. The wealth middle class in developed nations typically belongs to this group. Above them, the top tier of high-net-worth (HNW) individuals (i.e. US dollar millionaires) remains relatively small in size, numbering 59.4 million or 1.1% of all adults. The number of global millionaires has been growing rapidly in recent years and exceeded 1% of adults for the first time in 2020, although the number fell by 3.5 million in 2022. In terms of wealth ownership, the HNW group is increasingly dominant. The aggregate wealth of HNWs has grown five-fold from USD 41.4 trillion in 2000 to USD 208.3 trillion in 2022, and their share of global wealth has risen from 35% to 46% over the same period.

US Wealth Inequality 1990-2022

Over the past three decades the wealth held by the highest-earning 20% of Americans grew; in contrast, the wealth of those who earn less declined.

Opposition to a Central Bank

Opposition in the United States to a central bank empowered to issue currency is not new. Twice before in the nation’s comparatively short history it was created and abolished. Presidents and thinkers, including Thomas Jefferson, James Madison, Andrew Jackson, Abraham Lincoln, Otto von Bismarck, James Garfield, William McKinley, Theodore Roosevelt, John Hylan (Mayor of New York 1918-1925), Woodrow Wilson, and even Thomas Edison warned us about the consequences of giving a central bank the power to issue currency; Dwight Eisenhower worried about the potential for lopsided influence of the military industrial complex, and John Kennedy, without mentioning names, made it clear that he abhorred secret societies, oaths, and proceedings. On that note, it’s worth remembering that the Fed’s present incarnation was conceived in 1910, during a very secret meeting attended by Nelson Aldrich, A. Piatt Andrew, Henry Davidson, Arthur Shelton, Frank Vanderlip and Paul Warburg, a German immigrant, in Jekyll Island, Georgia. Incidentally, Lincoln, Garfield, McKinley, and Kennedy were assassinated, and Jackson and Roosevelt narrowly survived assassination attempts. Even Donald Trump, possibly for unrelated reasons, has so far survived not one but two assassination attempts. So, the record shows a progression, no doubt coincidental, from opposition to central banks, to rejection of “secret societies, oaths and proceedings”, to attempted and actual presidential assassinations.

The Constitution and the Fed

One thing is to have a bank of last resort that regulates, supervises and insures entities under its jurisdiction. Quite another is to bestow on it license to create and control the nation’s money supply at will, either from thin air or by whatever schemes it may from time to time concoct. That is anathema to the intent of the Founding Fathers, reaffirmed by the Supreme Court. Article I, Section 8, Clause 5 of the Constitution gives Congress the exclusive power of coinage.

Beliefs

There are those who believe that the primary beneficiaries of the Fed are the largest banks and the Federal Government itself, which is able to tap the former’s ability to create money as a supplemental form of revenue. They also point out the dramatic decline in the value of the dollar since the Fed was established in 1913; that over time it’s been granted ever more leeway in how it inflates the money supply; that when it buys Federal debt it does so with money created out of thin air; that arbitrarily, or nearly so, it sets the federal funds rate at whatever rate it sees fit; that it intervenes in currency and other markets; and that Congress has practically abrogated its responsibility and authority to rein it in. More importantly, they say, the Fed underwrites the Executive’s ability to bypass Congress to wage wars at its discretion by perpetually increasing the public debt. Case in point, the last time the United States Congress formally declared war was in 1942, against Hungary, Bulgaria, and Romania, today’s allies.

The Fed is Just a Tool

The Fed is not the problem per se. Rather, it’s the Federal Government’s lack of fiscal discipline, precisely what Thomas Jefferson so vehemently opposed. Worse, the trend has metastasized to nearly every country in the world, complete with national central banks, steep inequality, growing deficits, “defense” outlays, and sovereign debt. Accordingly, it would be ludicrous for the U.S. to unilaterally dismantle that which nurtures its national security shield – the military-industrial complex that worried Eisenhower – if no one else follows suit.

The Impossible Gold Standard

Currently no universal mechanism exists to compel national governments to live within their means. In the U.S., the gold standard was supposed to do just that from the late-19th century until 1933, when President Franklin Roosevelt confiscated all privately held gold. The gold standard proved unpopular, and ultimately failed, because it prevented the government from waging wars at will and addressing emergencies like the Great Depression. The Breton-Woods agreement of 1944 recreated a watered-down gold standard of sorts. Under its terms, the dollar was pegged to the price of gold and all other currencies were pegged to the dollar. That came to a screeching halt in 1971, when Richard Nixon ended the dollar’s convertibility into gold. He did so because other countries, particularly France under Charles De Gaulle, were redeeming paper dollars for bullion, a trend that threatened to leave the U.S. without gold reserves. Nixon’s action highlighted an obvious limitation to a gold standard: since the supply of gold is limited, nations who hoard it preclude others from doing the same to support their currencies. Nixon abruptly made the dollar a fiat currency – backed by nothing. However, the greenback’s acceptability was artificially inflated when Saudi Arabia agreed to price oil in dollars exclusively. The need for dollars to pay for oil, an indispensable commodity, created infinite demand for it. That effectively opened the floodgates to permanent deficit spending and mushrooming debt.

Declining Growth

The Congressional Budget Office’s 2024 Long-Term Budget Outlook estimates that “The state of the U.S. economy in coming decades will affect the federal government’s budget deficits and debt… Among the factors incorporated in the agency’s long-term economic forecast are the effects of projected deficits on private investment and the effects of marginal tax rates on the supply of labor and private saving. In CBO’s extended baseline projections, the growth of real potential GDP slows, falling from an annual average rate of 2.1 percent over the 2024-2034 period to an average of 1.6 percent over the 2045-2054 period.” In contrast, the International Monetary Fund projects China’s growth to slow to 3.3% by 2029 due to an ageing population and slower expansion productivity. Even this conservative projection is almost three times faster than the U.S., and India and other countries are growing even faster. In other words, unless something radical is done, and fast, the U.S. will lose its economic and military competitiveness.

Climate Change, an Unexpected Catalyst

Climate change – unrelenting and impervious to petty disputes – may actually spawn a currency standard that might compel all governments to live within their means. Here’s why. Anthropomorphic climate change is caused by humanity’s persistent use of fossil fuels to generate electricity and power vehicles. In response, there’s a worldwide race to develop a profitable method to generate electricity from fusion. To say the least, this is an expensive undertaking available only to rich nations which can afford the research and development. Accordingly, if and when a breakthrough is finally made, the proprietary rights to the technology would likely spawn a mega cartel not unlike today’s OPEC. In the event, its owners would directly or indirectly collect on virtually every human endeavor simply because everything we do requires energy. That would include, among others, sectors such as banking, robotics, manufacturing, artificial intelligence, even healthcare. If that happens, the currency of whoever owns the rights to fusion will likely become the reserve currency of the world, a path that leads to deficits and growing debt.

Green Hydrogen, an Alternative

China has made a groundbreaking advancement. It designed and debuted a hydrogen-powered high-speed train at the 2024 trade fair in Berlin, Germany, a highly industrialized country without sizeable domestic oil and gas reserves. This seminal step in energy independence complements a 2023 Memorandum of Understanding signed by Conjuncta, a German project developer, for a green hydrogen project in Mauritania. At no point in the production/use cycle will hydrogen release greenhouse gases into the atmosphere; not only that, since the raw materials – sunlight and seawater – are free, easily accessible, practically infinite, and in the public domain, no one would likely succeed in securing exclusive rights to them. Simply, if Mauritania can mass-produce green hydrogen, so can other developing nations.

Green Hydrogen Standard, not Gold

Green hydrogen – an energy carrier, not a fuel per se – has the unique ability to produce pure water as a byproduct. That is potentially a game-changer for arid regions. For example, the water byproduct of electric hydrogen-burning plants atop mountain ranges could be collected, condensed, and used to replace the shrinking supply of water due to recurring severe drought, retreating glaciers, and stressed aquifers. In sum, hydrogen’s advantages may likely encourage a multitude of nations to emulate the Mauritania project. Should that become a widespread trend, they might collectively agree to adopt hydrogen as the world’s standard to determine the relative value of each participating currency to the corresponding nation’s per capita production of green hydrogen. This all-inclusive valuation method would replace the International Monetary Fund’s Special Drawing Right (SDR), an international reserve asset subjectively based on a basket of five privileged currencies – the US dollar, the euro, the Chinese renminbi, the Japanese yen, and the British pound sterling. In doing so, it would comply with Eisenhower’s wish – to create a confederation of equals, one where the weakest can “come to the conference table with same confidence as do we, protected as we are by our moral, economic, and military strength.” In this confederation, confidence would be derived from economic self-reliance.

Unlike gold, whose value is derived from someone’s ability to hoard it inertly to preclude others from doing the same, the value of hydrogen is realized only when it is consumed. That would encourage modest nations to produce as much of it as possible. Landlocked nations such as Mongolia, Bolivia or the Central African Republic might partner with others, near or far, with an adequate seashore and abundant sunshine but in need of capital infusion, to share profits from the production of the hydrogen.

Effect on Fiscal Discipline

A hydrogen standard would not infringe on any nation’s sovereignty. Thus, any national government would be free to have a central bank performing any functions it sees fit, to binge on deficit spending, and to amass as much debt as it wishes. But the value of its currency relative to others would be determined by an automatic and unappealable per capita output of green hydrogen. That would materially affect international trade because the currency of nations with a high per capita output of green hydrogen, balanced budgets and low sovereign debt should have higher purchasing power. In sum, green hydrogen, not gold, is a good candidate to become the universal determinant of fiscal discipline.

Status of the Dollar as the World’s Reserve Currency

According to the International Monetary Fund (IMF), the U.S. dollar share of global foreign exchange reserves declined from roughly 73% in 2000 to about 56% in 2020 despite the dollar’s continued appreciation during that period. That works out to 17% over twenty years, or .85% per year if measured lineally. But there are dynamics at play that may increase that. One is that more countries are scheduled to join BRICS, an organization that seeks to develop a proprietary medium of exchange for members. Then there are the unresolved and worsening tensions in the Middle East, the South China Sea/Taiwan, Ukraine, and the mushrooming accumulated debt of the United States. These factors cannot be swept under the rug. Yet, our presidential candidates are largely mum on how they intend to face the day of reckoning, when the government is either forced to pay stratospheric interest rates to attract bond buyers, or when other countries simply stop accepting dollars in payment for their goods and services. In short, if green hydrogen is ushered in, no one will enjoy the undue advantage of cornering the coveted status of the world’s reserve currency. Not the U.S., which will eventually lose it anyway, nor China.