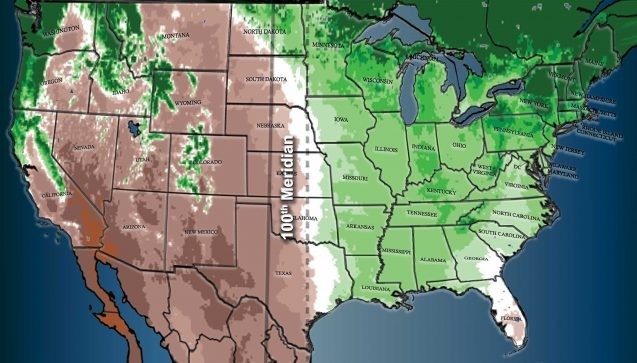

The boundary between the arid West and the moist East may have shifted 140 miles east, from the 100th meridian to the 98th.

Poverty, Inequality, and Hydrogen

“Unlike some other calculations, those relating to poverty have no intrinsic value of their own. They exist only in order to help us make them disappear from the scene…. With imagination, faith and hope, we might succeed in wiping out the scourge of poverty even if we don’t agree on how to measure it.” Molly Orshansky

Background

On February 07, 2023 President Biden outlined some of his Administration’s accomplishments, among them that 12 million new jobs (800,000 in the manufacturing sector, a small minority) were created over the last two years and that the unemployment rate has declined to 3.4%, a 50-year low. However, he omitted core underlying issues that threaten the nation’s economy and require immediate action: a high poverty rate, a yawning wealth gap, a chronic nationwide housing shortage, an ever-growing federal accumulated debt (the largest in the world), an unsustainable trade deficit, a high probability that the U.S. may become a net importer of food due to growing water scarcity west of the 98th meridian (the boundary between the “arid” west and the “humid east” has shifted about 140 miles east of the 100th meridian and now bisects the nation equally), the depletion of the Ogallala, Arizona, and California aquifers, and the catastrophic consequences we’ll all face when the petrodollar ceases to be the dominant reserve currency of the world. In all fairness, he’s not the only president that has not publicly addressed these issues, however sooner or later he or his successors will have to do so.

Poverty Thresholds

The poverty thresholds were originally developed in 1963 and 1964 by Mollie Orshansky, an economist working for the Social Security Administration (SSA). As she later indicated, her original purpose was not to introduce a new general measure of poverty; rather, she tried to develop a measure to assess the differentials in opportunity among different demographic groups of families with children. Her work was tweaked over the years; in 1992 the National Research Council’s Committee on National Statistics appointed a Panel, at the request of a Congressional committee, to conduct a study for a possible revision of the poverty measure.

Poverty has many levels and types, and while related to extreme inequality, it is not congruent with it. For example, the economic deprivation of three separate persons earning $500 per year below, at, or above the officially recognized poverty threshold for a single individual would, for all practical purposes, be equally dire. Yet, the one who exceeds it might not qualify for public assistance including subsidized housing, food, in-home long-term care, medical care, or transportation. Unsurprisingly, some extremely poor or homeless persons intentionally commit crimes because for them, jail is a step up.

Poverty, like wealth, can be inherited. At least one study has found that career earnings premium from a four-year college degree (relative to a high school diploma) for persons from low-income backgrounds is considerably less than it is for those from higher-income backgrounds.

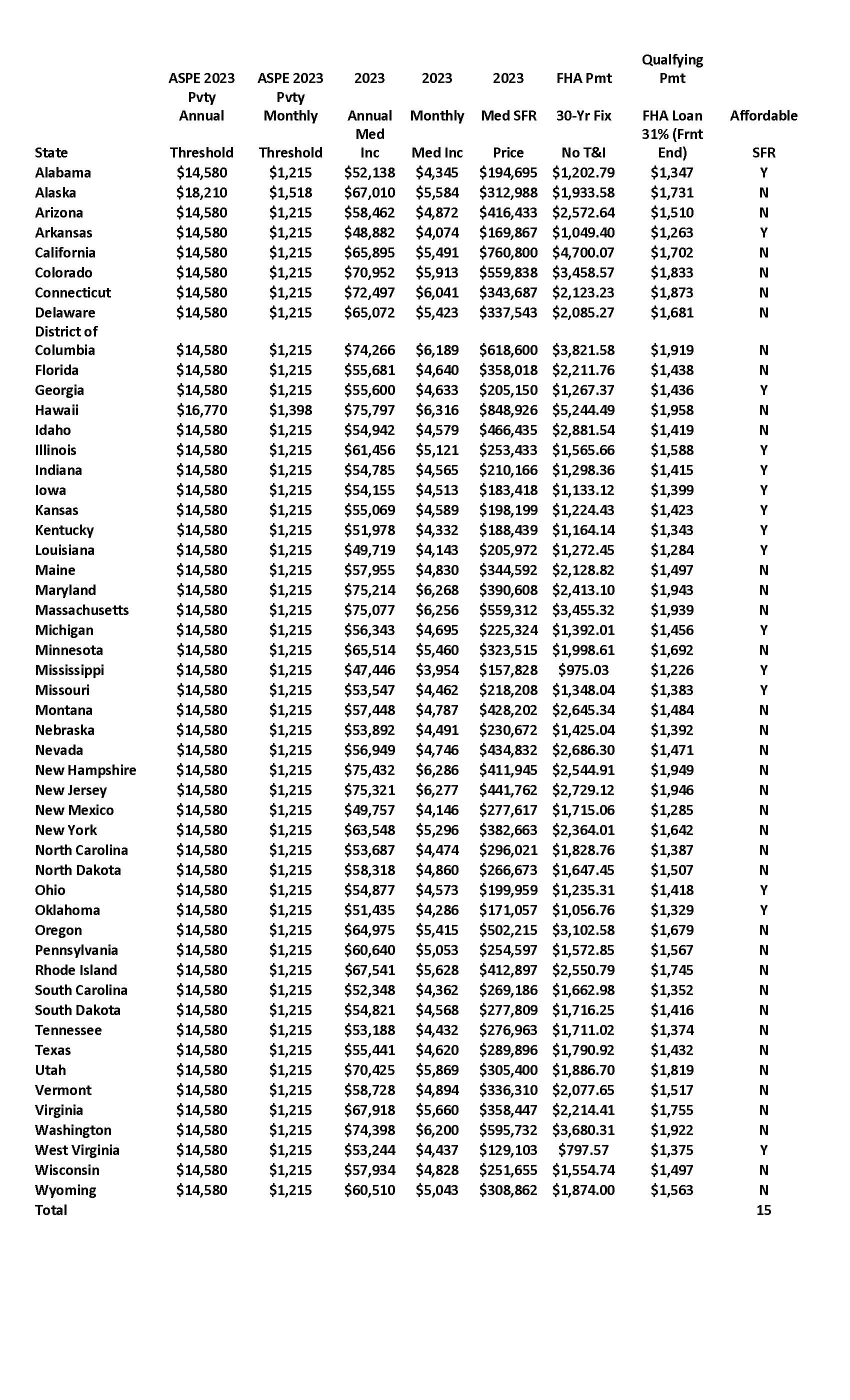

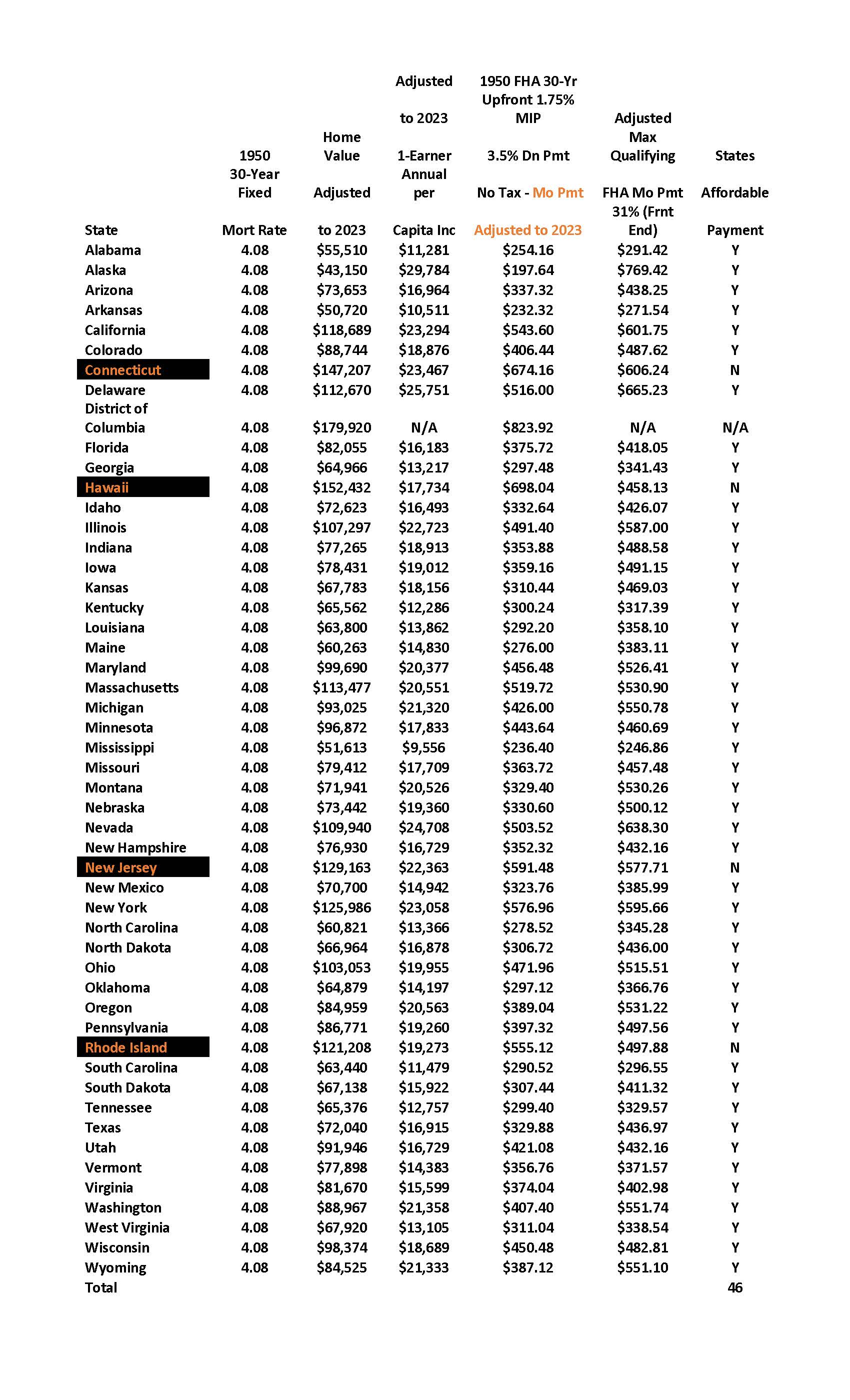

Economic, political, social, and even foreign policy issues are interconnected. However, though the working classes contribute the indispensable labor that supports the economy, the arbitrary and obsolete method the government uses to determine who is and who is not poor ignores two crucial criteria: (a) the static, growing inability of single individuals earning no more than state median incomes to purchase single-family dwellings, and (b) the growing gap in the distribution of wealth. In the 1950s the economy grew by 37%; high school graduates and 15 million returning GIs could expect to get a lifetime job without a college degree in manufacturing, buy a house and a car, and raise a family with two kids –on one income. In contrast, as of 2022 fewer than 9% of jobs are in manufacturing, and there is a glaring mismatch between today’s virtually non-existent job security, growing consumer and student debt, and a 30-year mortgage. Clearly, by the President’s disclosure, 800,000 new manufacturing jobs, or 6.7% of all the new jobs created, are not going to restore the happy stasis of the 1950s.

For all intents and purposes real estate resembles a giant (but legal) Ponzi scheme. Low home-building rates perpetually push prices ever higher. This illusion of wealth, based on ever increasing debt, masks the economy’s failure to reward the working classes with upward mobility based on hard work and loyalty. Ever-increasing prices happen to protect lenders, GSEs (Government-Sponsored Enterprises) and investors from catastrophic foreclosure rates –and insolvency. But the system is stacked against single, young, working-class people. Even before they get their first job, they’re often saddled with enormous student loans –debt that cannot be discharged in bankruptcy- that effectively prevent them from qualifying for a mortgage. And this doesn’t even take into account additional debt for a car –a necessity in most parts of the country- or consumer debt. Thus, to qualify for a mortgage, first they must either find a mate in similar or better financial condition, risking early divorce or separation and foreclosure, or live with their parents indefinitely. Of course, these circumstances have many ramifications detrimental to the nation’s overall well-being, among them a declining birth rate, a rising mortality rate, and alarming drug addiction statistics. The wealthier classes have not been affected to the same extent. In the third quarter of 2022, 68 percent of the total wealth in the United States was owned by the top 10 percent of earners. In comparison, the lowest 50 percent of earners only owned 3.3 percent of the total wealth. This dangerous imbalance must be addressed and dealt with.

Tables 1 (1950) and 2 (2023), while simplified and not intended to dwell into full underwriting analyses, illustrate the difference between the two eras in terms of buying power of one-earner incomes relative to the median prices of single-family homes. This difference should be adopted as the immutable standard for measuring poverty: the premise that any single-earner whose income is insufficient and/or unstable to buy a single family home over thirty years is, in fact, poor. Using Table 2, only 15 states (out of 50) have median single-earner incomes high enough to qualify. In other words, individuals in 35 states who make no more than the single-earner median income are poor.

Whatever we have done has brought us to where we are. Accordingly, we cannot expect a different result if we continue doing the same thing. Worse, for the first time in our short history we are competing for the hearts and minds of the Global South with China, a country with a population four times larger and of at least equal (and growing) economic strength. The entire world is keenly aware of China’s track record of having lifted 800 million from poverty in 40 years. As a result, China is now either their largest or second largest trading partner and the yuan is rapidly making inroads in challenging the dollar’s perch as reserve currency of the world. Either we make drastic systemic changes to produce a different result, or we may sooner rather than later find ourselves staring into the bottomless abyss of irrelevance.

The rise of China should neither be cause for alarm nor push us into a Thucydides trap that annihilates the world. Indeed, India will also follow suit, and as they continue to grow, they will concurrently demand energy and water on an unprecedented scale. Accordingly, the world should consider designing and gradually adopting a new economic system that reduces inequality within and among nations and simultaneously satisfies everyone’s minimum energy and water needs. This could be done not by confiscating existing property or laying onerous taxes but by distributing future wealth using a neutral global reserve currency (Special Drawing Rights might do) based on the production or use of green hydrogen on a per capita basis plus other economic activity. For example, a minuscule, sparsely populated but sun-drenched island nation whose economy has heretofore relied on fishing and tourism could build a solar-powered plant to produce green hydrogen by electrolysis of seawater. That would qualify it to have far more SDRs allocated to it, and since seawater and solar energy are for practical purposes inexhaustible, the island would have a strong incentive to produce as much hydrogen as possible. How it would allocate the new income among its people to reduce domestic inequality and poverty would be up to its government. The same principle would apply to large nations. The U.S., which has lost its manufacturing base, could make up for it by investing in a vast number of hydrogen-producing plants as outlined here. This is the wave of the future. In fact, China has already broken ground on the world’s largest green hydrogen plant. In contrast, despite the immense advantage of having a western (Pacific) ocean in close proximity to Death Valley, which could be converted into the world’s largest green hydrogen producing hub, the U.S. is paralyzed by a multitude of competing bureaucratic fiefdoms. Not only does this prevent taking emergency action to combat climate change and water scarcity west of the 98th meridian, every day of inaction sets us further behind.

Reality

Interstellar technology, awesome but still in its infancy, has taught us that our common home, smaller than a speck of dust relative to the visible universe, floats in space at the mercy of gravity and other celestial events that we don’t fully understand or control. In fact, our level of ignorance is such that we don’t even know precisely what gravity is, and we’ve nowhere else to go.

One would think that sentient beings in a predicament of this magnitude -isolated and helpless- might eagerly and humbly seek, by default, a stasis of cooperation, justice and reasonable equality for all on the self-evident assumption that only thus might the species hope to survive.

But no. There are those among us who think they’re entitled to impose their will on others. Their ambition, lust for power and sheer evil is indeed primeval. Sacred and historical books round the world, irrespective of religion, language or civilization, testify to this. The difference is that prior to 1945 alpha humans did not have the power to destroy life on the entire planet. Since then, not only has technology improved exponentially, the efficiency of weapons of mass destruction and their proliferation have expanded to nations that were not even independent at that time.

It is not the weapons that threaten us with extinction; they’re inert unless expressly activated. It is our universal urge, to different degrees, to use them to dominate others, to make them sweat in our stead so we can lead charmed lives of leisure at their expense. This in the age of the internet, satellites, artificial intelligence, drones, robots, and evermore sophisticated sources of energy.

Proliferation of knowledge, individual brilliance, and the courage to seek justice at any cost cannot be compressed and confined into a modern-day Pandora’s Box. Accordingly, leaders of nuclear armed nations should understand that they bear the awesome responsibility to prevent the extinction of the species. And the only way to do so is to graduate to an enlightened stage of mutual cooperation, justice and reasonable equality so weapons of mass destruction can be eliminated. No less luminaries than Presidents Eisenhower, Kennedy, Reagan and Gorbachev, among many others, agreed.

The Ukrainian Crisis III

Background

On September 22, 2022 at a House of Representatives’ hearing, Rep. Rashida Tlaib asked JPMorgan Chase CEO Jamie Dimon, “Please answer with a simple yes or no, does your bank have a policy against funding new oil and gas products.” Dimon responded, “Absolutely not and that would be the road to hell for America.”

Rep. Tlaib did not ask where these new oil and gas products might be located, and Dimon, a savvy and experienced banker, did not elaborate. Oil is a finite resource. The term peakoil, introduced in 1956 by geophysicist M. King Hubbert, posits that extraction of a finite resource in any large region rises along a bell-shaped curve that peaks when approximately half of the commodity has been extracted. Although the Department of Energy has not publicly disclosed the specific date when this will occur, inevitably oil will become prohibitively expensive to extract. At that point, absent an as yet nonexistent global market of high-tech fuels such as cold fusion or anti-gravity, consumers will be forced to pay increasingly higher prices for energy generated from petroleum and natural gas. In addition, profound complications, incipient changes, the historical record of today’s main players, the ever-present (and growing) probability of nuclear war, and the immutable gorilla in the room –climate change- require global cooperation, not confrontation.

Concerns

The U.S. has good reason to be concerned about China’s rise. The former is a new nation that has never had to contend with a comparable economic power with a much larger population. In addition, no one knows, including China’s present leadership, how it is going to behave if and when it achieves full nominal parity with (or surpasses) the U.S. and President’s Xi’s mandate inevitably ends.

Where Things Stand

The recent agreements signed by Saudi Arabia and China, include, among other things, possible payment by China for Saudi oil in yuan, not dollars and production of green hydrogen. This is a seismic event neither the United States nor the rest of the world should ignore. Absent effective long-term market-based countermeasures (not military, which would end life on this planet as we know it), the yuan is set to challenge the U.S. dollar for reserve currency of the world. If that happens, it would bestow on China the unique privilege to overspend big time in its military-industrial complex and to export part of its inflation just as the U.S. has done since the advent of the petrodollar. Conversely, it would deprive the U.S. from continuing to do so . In addition, given China’s fourfold advantage in tax paying consumers, a bigger GDP in terms of PPP and a larger manufacturing sector, it is difficult to discern how the U.S. would be able to compete, under present policies, with China’s rapidly expanding navy, as of this writing the largest in the world.

Purpose of These Suggestions

The political and economic beliefs and policies that shaped the Twentieth Century are water under the bridge. Not only have they failed to perpetuate America’s economic hegemony, they won’t contain China and India’s economic growth and their consequent insatiable demand for energy. Accordingly, to avoid falling into the abyss of irrelevance that has devoured all other great empires, the U.S. might want to consider a new approach designed to render inert the increasing danger of thermonuclear war, replace all fossil fuels, nuclear fission and even fusion with green hydrogen drastically reduce the extreme inequality in wealth and income among and within nations , create a mechanism to permanently relieve the lack of affordable housing for the lower and middle income classes , restore job security (today’s extreme job insecurity is not compatible with 30-year fixed mortgages that require borrowers to rely on jobs they may lose at any time, for any reason, at their employer’s discretion and with little or no warning), and upgrade health care (in the U.S.) to a guaranteed right for all.

The Solution – Symbiotic Trade

The logical way to compete peacefully and effectively is to emulate China in terms of trade. We should sell them (and India) that which neither they nor anyone else other than the U.S. can produce on a scale commensurate with their needs: green hydrogen. While its advantages over fossil fuels are many, nine are particularly important. (1) Unlike electricity, which cannot be exported overseas, hydrogen can. So, for example, green hydrogen produced in Hawaii could be exported to China, India, Europe and Japan (which are not self-sufficient in energy) where it would be burned to generate electricity and power vehicles. (2) When used to generate electricity, its byproduct (steam) could be collected, condensed and used where needed; this would greatly lessen the impact of drought, increase production of food, and plant trees. (3) There would be no greenhouse emissions, essential to combat climate change. (4) The U.S. trade deficit would either become a surplus or be reduced on an unprecedented scale. (5) The surplus would strengthen the dollar and increase demand for it. (6) If done on this scale, millions of new jobs would be created in the U.S. (7) If properly distributed, a portion of the income from the hydrogen could be used to fund, over time, a plan to mass produce affordable housing for the poor and the middle class. (8) Since hydrogen would replace fossil fuels, control of existing oil and gas reserves would no longer be a bone of contention among the great powers. As a result, the probability of thermonuclear war would be greatly reduced.

Green Hydrogen

A World Without Oil

It’s no secret that the probability of nuclear war between the U.S. and Russia is higher than at any time since the 1962 Cuban Missile Crisis. . Presidents Biden and Putin have said so. But if fossil fuels, particularly oil, cease to be used, there would be no bone of contention over the world’s dwindling oil reserves. By the same token, the petrodollar would cease to exist (the rest of the world would not need to earn dollars to pay for it), and oil producers like the U.S., Russia and Iran would have to rely on something else other than oil to prop up their economies. As Russia would have much less revenue to spend on weapons, there would be no defensive reason for NATO’s very existence. Likewise, since the oil reserves in the Caspian region and Central Asia would become obsolete, so would NATO’s “open door policy” along Russia’s southern border. The same would apply to OPEC+ due to lack of demand for their product. Even the Ukrainian war would lose its appeal given that neither Russia nor the U.S. governments would be able to spend more than they earn. In Asia, oil would no longer traverse the Malacca Strait; as a result, it would lose much of its strategic appeal. Finally, almost as an afterthought, Taiwan’s relevance as gatekeeper of that strait would become moot. All told, the disappearance of the oil market should significantly reduce the risk of thermonuclear war.

Nuclear Fission

Spent nuclear fuel generated by fission reactors have a half-life of 24,000 years. While no catastrophic spills of this fuel have yet occurred and the technology to recycle it to generate still more electricity has improved, no one can guarantee that it won’t ever happen. Recycling helps but does not completely eliminate the waste. The most modern method to recycle spent nuclear fuel would generate no more than 30% of France’s electricity, meaning that 70% would still have to come from other sources (the U.S. does not recycle its spent nuclear fuel ). In addition to the spent fuel, fission plants can have accidents as in Fukushima (radioactive water is periodically being dumped in the ocean) and Chernobyl, where its long term effect on wildlife is unclear but still dangerous in some areas. And then, of course, there’s the ambulatory menace: nuclear-powered warships, none of them unsinkable and all of them potential individual sources of uncontrolled radiation poisoning deep in the ocean spread by all-powerful global currents. Given the growing risk of war, it is imperative that we do away with fission before it does away with us.

Fusion

Fusion is the process by which two light nuclei combine to form a single heavier nucleus, releasing a large amount of energy. On December 13, 2022 the National Nuclear Security Administration of the U.S. Department of Energy announced that on December 5, 2022 a controlled experiment at Lawrence Livermore National Laboratory achieved scientific energy breakeven, meaning that it produced more energy from fusion than the energy used to drive it. However, though important, the breakthrough is not going prevent catastrophic climate change . It is understood that hydrogen from the ocean would be used in a reaction were it would yield (lots of) energy and helium, an inert gas. Essentially, fused hydrogen would cease to exist as such. As a result, since hydrogen is necessary to form water, a corresponding amount of it would also decline. While it may seem that the ocean is a limitless reservoir, it would be the first time since its formation that water would be systematically destroyed -an irreplaceable loss. Current scientists and politicians cannot possibly anticipate what uses future colleagues might dream up that would require an exponential increase in the destruction of water. Since this is an issue that will affect all living things on the planet, it is a perfect opportunity to practice what we preach: democracy. Have the people of the entire world, regardless of nationality, vote on it, and commit to respect the outcome. That way we –all of us- can collectively assume the responsibility of this monumental decision on behalf of life.

Elements of Confrontation

Fear of being overpowered, greed, lust for power, nationalism, ethnic scorn, and past wars are of course common seeds of confrontation. However, they all pale compared to the need for all countries, including the U.S., Europe, China and India, to have guaranteed access to the world’s largest oil and gas reserves to meet their domestic demand. And competition for control of these reserves, the bulk of which are in the Persian Gulf and Venezuela, is growing.

The Players

Top Ten Economies, Real Gross Domestic Product (GDP)

Real GDP Manufacturing Manufacturing

Trillions $ Percent Trillions $

United States 20.94 11 2.30

China 14.72 27 3.97

Japan 5.05 20 1.01

Germany 3.84 18 0.64

United Kingdom 2.08 9 0.19

India 2.66 14 0.37

France 2.63 9 0.24

Italy 1.88 15 0.28

Canada 1.64 10 0.16

South Korea 1.63 25 0.41

Currencies

The United States

The outstanding debt of the United States is $31 trillion, or 1.43 times the real GDP. Nevertheless, despite the pressing need for extensive domestic investment, America’s assistance to Ukraine, which is not an official ally, now tops that given to any other nation in the last century. Clearly that simple fact cannot be explained by altruistic or moral reasons. It makes sense only if strategic interests of exceptional importance are at stake such as the dismemberment of the Russian Federation. Having concluded that the combined Russia/China challenge is an existential threat, someone in power has concluded that, under present circumstances, the U.S. simply cannot back down from sustaining Ukraine. Several high-ranking American officials have repeatedly stated that the U.S. will do “whatever it takes” to enable Ukraine to defeat Russia. In truth America’s reputation is at stake, and with it, the dollar’s cherished status as reserve currency of the world. Losing it would be nothing short of nightmarish for the U.S. economy: runaway hyperinflation, depression, government default, inability to maintain military expenditures anywhere near today’s level, social chaos, martial law, even a high likelihood of a failed state. The devastation would be magnified several orders of magnitude relative to China because America’s manufacturing sector accounts for only 11% of the economy whereas China’s manufacturing stands at 27% of its economy. No, under those circumstances the U.S. would not be able to keep up, much less surpass, China’s military output. In short, this primeval fear is nothing less than an archetypical reenactment of Thucydides’ trap where, ironically, Sparta is the U.S. and Athens is China.

Europe

The euro is a fiat currency (all modern currencies are) issued by the national central banks of the Eurosystem or the European Central Bank. As the Eurozone does not have a unified standing army raised from its member nations, global military weight is limited.

China

China’s economic, political, and (growing) military clout stems from its growing technological prowess, large manufacturing capacity, huge consumer base, perennial trade surpluses, the unparalleled feat of having lifted at least 800 million people from extreme poverty over 40 years , and a peaceful Belt and Road Initiative that insidiously erode, in the aggregate, America’s economic influence. More importantly, the yuan has emerged as a budding exchange medium for a small but growing percentage of oil transactions that may, in time, topple the dollar from its perch as RCW. At that point it is not inconceivable that China might someday successfully sanction the U.S. rather than the other way around. These and other considerations may have contributed to the Department of Defense’s conclusion that China is America’s top security threat.

China’s Risk

Were Russia to be dismembered into a myriad of inconsequential states, enormous mineral reserves throughout Asia, including oil and gas, would literally come up for grabs. In that situation the collective West, backed by NATO, could attempt to choke off China’s two main sources of oil –Asia, and the Persian Gulf. If successful, that would automatically give the U.S. dollar a new lease on life as RCW (reserve currency of the world) and indefinitely postpone the day of reckoning stemming from the perennial twin (trade and fiscal) deficits and the (growing) $31 trillion accumulated debt. So, Ukraine and Taiwan are not really unrelated; they’re actually essential cogs in the strategy to neuter Russia and China: the former because it is an irreplaceable destabilizer of Russia, and Taiwan because it is the lid of a Pandora’s Box that prevents the ever growing Chinese Navy, already the largest in the world numerically, from controlling the Strait of Malacca, the choke point through which oil from the Persian Gulf transits, after passing India, to the South China Sea on its way to China itself and American stalwart allies Japan, Korea and Taiwan. Thus, not only is China sure to face stiff competition from fast-growing India for the same oil and gas reserves currently nurturing the Chinese economy, it faces the daunting prospect of ensuring that energy supplies headed for China will actually get through.

Russia’s Conundrum

Russia’s economy, far smaller and not nearly as intertwined with the U.S. as China, is theoretically more vulnerable to U.S and European sanctions. But that does not alter the geographic reality. The distance from Shostka in northeast Ukraine to Moscow is roughly 300 miles, a few minutes flight time for modern missiles. To put this in perspective, during the 1962 Cuban crisis Kennedy was ready to go to war over Soviet missiles 1,200 miles from Washington, D.C. , four times the distance from Shostka to Moscow. NATO in Ukraine would give the former the capability to threaten near instant decapitation of the Russian government at any time and for any reason. From Russia’s perspective this possibility is amply supported by the historical record. Unclassified American/British plans (Operations Unthinkable (1945) and Dropshot 1957), among others, that sought to bomb and/or dismember the Soviet Union, are well documented. As a result, it is highly unlikely that Russia will back down from its core demand of an ironclad written guarantee that Ukraine will not be admitted to NATO. Accordingly, barring a total military defeat, it is difficult to imagine what would cause Russia to negotiate for peace from a position other than strength if the result fails to render Ukraine militarily inert. Any other result would all but collapse any remnant of rear and/or respect for Russia from other ex-Soviet states. Equally importantly, nations such as China, India and Iran, among others, which have not supported American-led sanctions, might re-evaluate their Russian connection.

The Global South

Latin America, Africa and the Middle East have several things in common. They’re all ex-colonies or “protectorates” of European powers, they’re governed by elite classes that became ensconced in power since independence, the income and wealth gap between to ruling class and the rest of the population is immense, and they never seem to graduate from “developing” to “developed” economies despite enormous natural wealth. In addition, the degree of poverty of their lower tiers of society is nothing short of scandalous, to the point that millions lack running water, food, and safe shelter. Not surprisingly, in recent years many governments in these regions have elected, when allowed to do so, left-leaning governments in the hope that laws will finally be passed to redress these issues. From their point of view, there has been a concerted effort by the ex-colonial masters to keep things as they are: the role of the global south its limited to supplying raw materials and cheap labor to the industrialized nations. This all but guarantees a continued class struggle for a more equitable distribution of wealth which, if achieved, might threaten the continued supply of raw materials to the developed nations. For many, China’s rise is proof that there now exists an alternate path to climb out of poverty. Its Belt and Road Initiative is source of hope for the southern masses, to the point the China is now either the largest or second largest trading partner with most of the world. This of course directly impacts the interests of the United States. Its manufacturing sector is much smaller than China’s and its comparable manufactured goods are invariably more expensive. In addition, its perennial trade deficit, particularly as it relates to manufacturing, means that it cannot export to poor countries. Case in point, the percentage of American-made automobiles in India, Africa, and Latin America is very small. This situation cannot be redressed with sanctions or coups. Instead, gradually and imperceptibly, the SDR (Special Drawing Rights) should be issued to all nations as a common currency. It would no longer be defined by a basket of privileged countries –the US dollar, Euro, Chinese Yuan, Japanese Yen, and British Pound. Instead, each country would be issued SDRs based in proportion to their production, or contribution as an investment to the production of, green hydrogen relative to their population. This would level the purchasing power for all nations and incentivize the production of green hydrogen. As a result, heretofore poor countries would be able to buy more industrial goods from other countries and in so doing, create jobs worldwide. The technology to do this already exists. What’s lacking is the political will to do so.