Hydrogen Economy

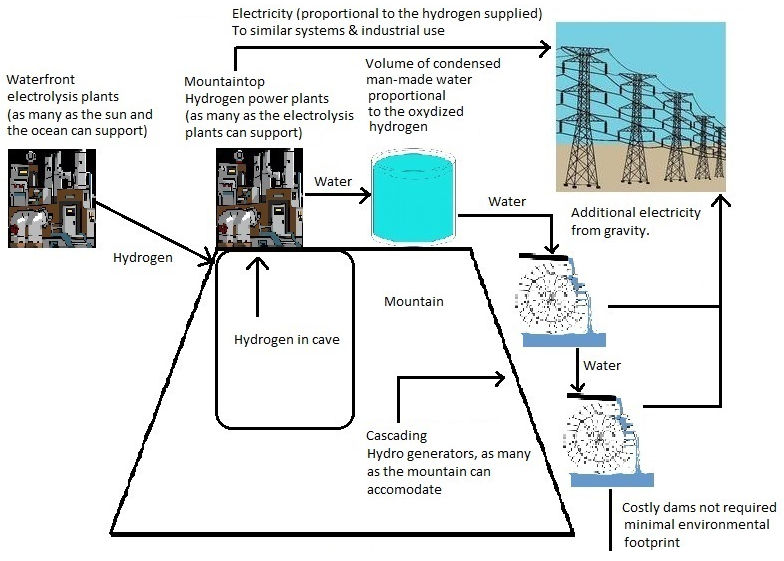

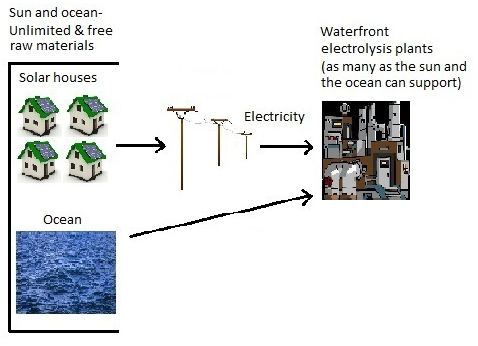

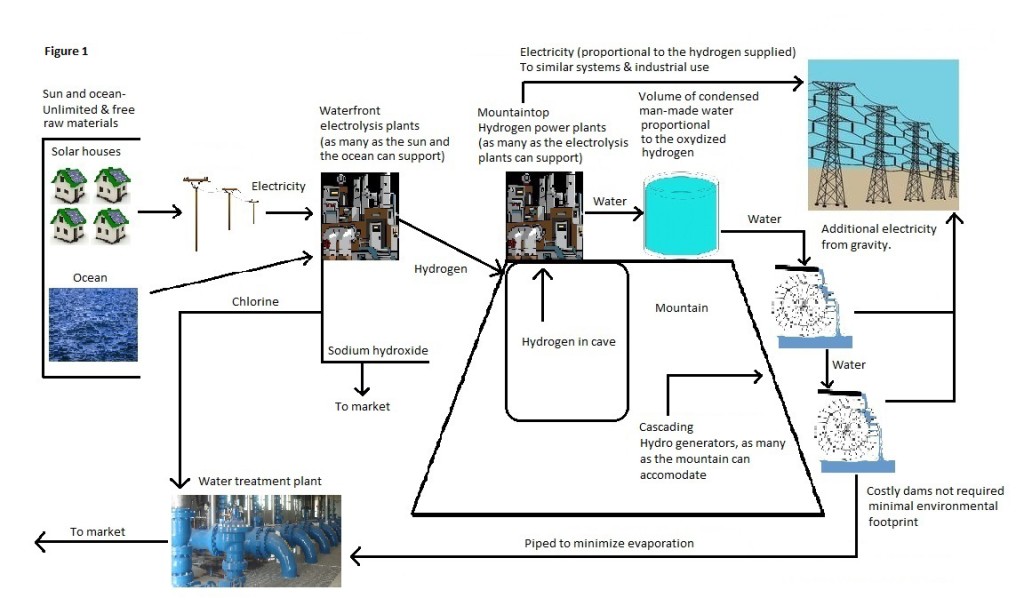

This diagram shows how green hydrogen produced by electrolysis of seawater using solar energy on rooftops could be used to generate electricity and steam in new plants on suitable mountaintops. The water would be collected, condensed, and fed to cascading turbines on the mountain slopes to generate still more electricity with the goal to recover the energy used to produce the hydrogen in the first place. This system does not use fossil fuels or any other type of energy. The technology to make this real already exists, including a 100% efficient water splitter without enzymes, a turbine capable of burning hydrogen 24/7 directly without fuel cells, and Polyethylene (PE) and epoxy resin anti-corrosive coatings for hydrogen pipelines. This would allow shorelines with abundant sunlight worldwide to out-compete fossil fuels to stop dumping greenhouse gases into the atmosphere.

After The Interview

Prelude

On February 8, 2024 Tucker Carlson interviewed President Vladimir Putin in Moscow. While the interview did not reveal anything new, Mr. Putin did demonstrate detailed knowledge of Russian history, mental agility, and a firm conviction that his understanding of the underlying reasons beneath the Ukrainian conflict is indeed factual.

Grievances

In a nutshell, Mr. Putin’s grievances against NATO in general, and the U.S. in particular, are as follows:

- In February 1990 Secretary of State James Baker III, famously said to Mikhail Gorbachev that NATO would not expand “one inch to the east.” Gorbachev then said “any extension of the zone of NATO is unacceptable”, to which Baker responded “I agree.” That of course implied a meeting of the minds between them. Two years later, within the context of the Russian-initiated dissolution of the Soviet Union and on the basis of Baker’s assent, Mikhail Gorbachev agreed to withdraw 450,000 Soviet troops from East Germany and allow it to unify with West Germany within NATO, a hostile alliance. Crucially, although Russia agreed that its borders would be “along the borders of the former Soviet Union’s republics” it never accepted NATO’s future eastward expansion. Then, in 1997, just five years after the Soviet Union’s demise, NATO declared at the Madrid Summit, that “…the Parties may, by unanimous agreement, invite ANY other European state in a position to further the principles of this Treaty and to contribute to the security of the North Atlantic area to accede to this Treaty. (…)” Since then, during that period of Russian impotence, NATO expanded 1000 miles east into 14 additional countries.

- In Mr. Putin’s eyes, “their goal is to weaken Russia as much as possible.” Someone within has convinced the political leadership that “it is necessary to continue ‘chiseling’ Russia, to try to break it up, to create on this territory several quasi-state entities, to subdue them in a divided form, and to use their combined potential for the future struggle with China.” He added, “…the U.S. political leadership pushed us to the line we could not cross because doing so could have ruined Russia itself.” Indeed, if Ukraine does join NATO, the latter would in effect recreate, without incurring NATO manpower losses, the Eastern Front as it stood in September 1941. The difference is that this time the U.S. would have the capability and authority to deploy, at its discretion, nuclear-tipped missiles about 300 miles and within a few minutes flight time from Moscow. Incidentally, by way of comparison, during the 1962 Cuban crisis President Kennedy was ready to go to war because the U.S. would not tolerate nuclear-tipped missiles 1200 miles from Washington, D.C.. As for Georgia, a quick look at the map reveals that almost the entire coastline of the Black Sea would be NATO-controlled. That would effectively prevent Russian ships from reaching the Dardanelles and allow NATO to sever, at its discretion, Russian-Iranian traffic in the Caspian Sea. The ensuing stranglehold would, as Mr. Putin surmises, in all likelihood collapse the Russian economy and government, cause the country to disintegrate into a myriad of powerless but resource-rich polities, isolate Iran, and give the U.S. and NATO the power to control the vast energy, mineral, and agricultural resources in the newly defunct Russian Federation. As bonus, this antidote to the threatened BRICS/OPEC merge would nip in the bud the incipient challenge to the dollar, continue to feed the government’s addiction to gigantic perennial deficits, preserve the value of dollar-denominated assets, protect the interests of those who own the lion’s share of the world’s wealth, and perpetuate the size, power and influence of the military-industrial complex. High stakes indeed.

- At a meeting in the Kremlin, Mr. Putin asked President Bill Clinton, “Bill, if Russia asked to join NATO, do you think it would happen?” At dinner later that evening, Mr. Clinton replied, “You know, I’ve talked to my team, no-no, it’s not possible now.”

- Mr. Putin told the President of the United States (did not say which one) that the U.S. should not support separatism or terrorism in the North Caucasus and gave him proof that it was doing so. The CIA later replied: “We have been working with the opposition in Russia. We believe that this is the right thing to do and we will keep on doing it.”

- Mr. Putin, who had previously repeatedly objected to a planned American anti-ballistic system (ABM), proposed to President Bush (presumably George W.) to instead create a joint U.S., European and Russian ABM to counter possible future missile threats from Iran. The U.S. declined the proposal.

- In 2008, at the Bucharest summit, NATO declared that it welcomed Ukrainian and Georgian Euro-Atlantic aspirations for membership in NATO.

Background

George Kennan, an American polyglot who mastered Russian, German, French, Polish, Czech, Portuguese and Norwegian, filled diplomatic posts in Lisbon and Moscow during World War II. In February 1946 he sent a “Long Telegram” from his post in Moscow to Washington, D.C. in which he advocated a policy of determined containment toward the Soviet Union. This brought him much recognition, and in 1947, during the Truman administration, he was named director of the State Department’s policy- planning staff. In July of that year, using the pseudonym “X”, he published an article in Foreign Affairs magazine where he questioned the wisdom of trying to appease the Soviet Union. He argued that the Soviets responded primarily to military force, and that for that reason it would retreat only in the face of unyielding Western opposition to its expansionist policy. Further, he believed that determined U.S. counterpressure would cause the Soviets to either cooperate with U.S. or lead to the collapse of the Soviet government. The U.S. subsequently adopted this view and enshrined it as its core policy toward the Soviets. However, in the late 50s Kennan revised his ideas and advocated instead for U.S. “disengagement” from areas of conflict with them. Specifically, he denied that containment was relevant to Vietnam. Then, in an opinion in the New York Times on February 5, 1997, Mr. Kennan stated in part: “In late 1996, the impression was allowed, or caused, to become prevalent that it had been somehow and somewhere decided to expand NATO up to Russia’s borders. But something of the highest importance is at stake here. And perhaps it is not too late to advance a view that, I believe, is not only mine alone but is shared by a number of others with extensive and in most instances more recent experience in Russian matters. The view, bluntly stated, is that expanding NATO would be the most fateful error of American policy in the entire post-cold-war era. Such a decision may be expected to inflame the nationalistic, anti-Western and militaristic tendencies in Russian opinion; to have an adverse effect on the development of Russian democracy; to restore the atmosphere of the cold war to East-West relations, and to impel Russian foreign policy in directions decidedly not to our liking. It is, of course, unfortunate that Russia should be confronted with such a challenge at a time when its executive power is in a state of high uncertainty and near-paralysis. And it is doubly unfortunate considering the total lack of any necessity for this move. Why, with all the hopeful possibilities engendered by the end of the cold war, should East-West relations become centered on the question of who would be allied with whom and, by implication, against whom in some fanciful, totally unforeseeable and most improbable future military conflict?”

A very relevant counterpoint existed to Mr. Kennan’s assertion that NATO’s expansion was “the most fateful error of American policy in the entire post-cold-war era.” Namely, that the disintegration of the Soviet Union, though a decisive cold war victory for the U.S., was insufficient. Russia, still a nuclear superpower, possessed abundant energy and other natural resources which made it a clear dormant threat to American dominance and security. That called for a preemptive drive to seek its further disintegration into a myriad of impotent successor mini states that would inevitably fall into the American unipolar system. And the quickest, most effective and least costly way to do so was to move NATO right up to Russia’s borders.

In March 1997, with an impotent Russia still reeling from the Soviet Union’s demise, Zbigniew Brzezinski, an influential anti-Soviet senior research professor of international relations who had served as foreign affairs adviser to Presidents Kennedy and Johnson and national security adviser to President Carter, espoused precisely that. Speaking at the United States Institute of Peace, he recommended a strong approach by the United States to overcome any objections to NATO’s expansion from any recalcitrant members: “To ensure a successful ratification process, the United States should make it clear that countries that fail to ratify enlargement are rejecting not only new members but also the United States; it will also be important to provide intermediate security arrangements for the Baltic states, although the greatest assurance will be U.S. clarity and commitment that NATO’s first expansion is the beginning of a process that will not be delayed for long. European uncertainty regarding a second enlargement of NATO should diminish when the first round has taken place and Russian predictions do not materialize.”

This was overt contempt for Russian military capabilities. The drawback to Brzezinski’s approach, of course, is that it treated Russia as an adversary at a time when it had ceased to be. NATO’s eastward expansion triggered, as Mr. Keenan predicted, “Russian foreign policy in directions decidedly not to our liking.” And, despite far-reaching sanctions from the U.S. and the European Union, it nudged Russia to expand its military-industrial output so that it now exceeds all NATO nations combined.

William Perry, former Secretary of Defense under President Clinton, subsequently supported Mr. Kennan’s view. In 2016 he stated that “the current level of hostility in US-Russian relations was caused in part by Washington’s contemptuous treatment of Moscow’s security concerns in the aftermath of the cold war.”

Changed Circumstances

Mr. Kennan, who died in 2005, wrote at a point in time when the national debt was a relatively benign $5.4 trillion or 44.12% of GDP; before China’s meteoric rise really took off after it joined the World Trade Organization in 2001, and before 2014, when its gross domestic product, measured in terms of purchasing power parity, surpassed the U.S.. Whether he might have revised his position under these new circumstances we’ll never know. What counts is that today the national debt, which stands at $34.4 trillion, or 124% of nominal GDP, is rapidly climbing; the unaffordable and unsustainable Ukrainian war is in full swing with no apparent end in sight, President Biden has proposed a $895.2 billion defense budget for fiscal 2025, interest outlay on the national debt as of February 2024 is $433 billion, or 16% of total federal spending in fiscal year 2024, and the likelihood of a direct war between the U.S. and Russia is higher than at any time since the Cuban missile crisis. And that’s not all. BRICS members Brazil, Russia, India, China, South Africa and Iran, among others, seek to establish a proprietary medium of exchange to challenge the dollar’s role as reserve currency of the world. Further, Saudi Arabia has been officially invited and is mulling whether to proceed, and Venezuela hopes to join in 2024. If both do, then OPEC and BRICS would essentially merge and control about 48% of the world’s proven oil reserves. In addition, since China, India and Russia collectively consume about 21.5% of the world’s oil output, slightly more than the U.S., which consumes 20.3%, they would have enormous leverage to set the price of oil.

The Conundrum

Russia regards NATO’s 2008 commitment to expand into Ukraine and Georgia, as stated in item #23 of the Bucharest Summit Declaration, a matter of life or death; and it has reacted accordingly by waging what it considers to be a preemptive war. Should it win, its victory would equate to a U.S./NATO defeat that would, at a minimum, severely dent the latter’s prestige and cast doubt on its ability to contain China, a much larger adversary.

The United States’ enormous debt, perennial fiscal and trade deficits and growing Chinese competition are, in the aggregate, critical to America’s long-term economic prognosis. Never has the U.S. faced an adversarial economic peer with a $35.04 trillion GDP in PPP terms and a population of over 500 million more than all NATO countries combined; and unlike Rome, Spain, France, Germany and Great Britain, the U.S. has yet to fall into the abyss of insolvency and irreversible decline. America’s $27.97 trillion GDP in PPP terms is 5.35 times larger than Russia’s current $5.23 trillion GDP. Consequently, that makes Russia the weak link in the Russo/Chinese chain, the target of choice to contain China and preserve America’s hegemony. That the U.S. proclaims unwavering support for Ukraine suggests that either it does not have an alternate plan to peacefully defend the dollar and its economy, or it is unwilling or unable, or both, to use it.

Additional factors are at play that increase the risk of an all-out NATO-Russia war. The once-powerful influence of the resources-poor former colonial powers, namely Western Europe and Japan, is now but a fraction of what it used to be. As a result, they support the U.S. and each other on Ukraine, Taiwan and the South China Sea, which antagonizes China. In addition, the Global South –India, Southeast Asia, the Middle East, Africa, and Latin America – can no longer be taken for granted or ignored. India is the world’s most populous nation and its economy is growing at over 8% per year, far and away faster than anyone else; and resources-rich Africa, whose population is growing faster than the rest of the world, is in the process of shedding any remaining ties with its colonial past. Indeed, the Global South does not approve of America’s weaponization of its proprietary financial system to impose its will on recalcitrant nations. In fact, its policy of leveling sanctions on Russia and others has severely eroded their empathy and goodwill toward the U.S.. Proof of that is that by and large the Global South has declined to support the U.S. and NATO on Ukraine. Lastly, the personal animosity between the current American and Russian leaders, which was not the case between President John Kennedy and Chairman Nikita Khrushchev, makes the current confrontation far more dangerous.

Overlapping Red Lines

For the U.S., a nation with 4.23% of the world’s population and a density of 37 persons per Km2, its top priority is to protect the dollar’s role as reserve currency of the world, and by extension, the unipolar financial dominance it’s enjoyed since 1945. Among other things this leverage has allowed the U.S. to spend beyond its means, incur perennial fiscal and trade deficits, and sanction anyone for any reason it sees fit. That policy is now being challenged by BRICS as it seeks to create a new medium of exchange to replace the dollar. Should they succeed, the consequences would seriously impact the U.S. and Europe.

Russia, the largest country in the world by area but with a population density of just 9 persons per Km2, perceives NATO’s expansion to Ukraine and Georgia as a mortal threat, and it is determined to neutralize it. Ominously, both the U.S. and Russia consider their mutually-exclusive red lines non-negotiable.

Historical Context

Since 1945 the dominant role of the dollar has been supported by the size and stability of the U.S. economy, its openness to capital flows, respect for property rights, rule of law, depth and liquidity of its financial markets, and the petrodollar’s long-standing preeminence. Presently these factors are all under siege.

But the world has changed. In 1947 France and Great Britain, practically bankrupt in the wake of World War II, quickly lost their global empires. Newly-independent India spun off Pakistan, and after almost 2000 years Israel was reinstated as an independent nation. Crucially, all three eventually became nuclear powers, something no one envisioned at the time. In 1949 the Soviet Union exploded its first atomic bomb and the communist Chinese won their civil war; and Taiwan, which had in 1945 reverted to the Republic of China following the Japanese occupation, became a self-ruled polity under the protection of the United States. By the early sixties most of Africa, Oceania and Southeast Asia had won their independence.

Today China pays substantially less than the U.S. for comparable high-end military hardware, so much so that its navy is now the largest in the world by number of ships. As for stability, America’s out-of-control perennial deficits and accumulated debt are beginning to become a matter of concern among some sophisticated investors. While the depth and liquidity of its financial markets remains healthy and robust, its policy of sanctioning recalcitrant nations has damaged its credibility. Case in point, in 2000 the dollar comprised 71% of disclosed foreign reserves; by 2022 it had declined to 58%. That works out to 0.59% per year over 22 years. No one knows how this trend will evolve, but if it continues its downward curve at the same rate, by 2046 it will plunge to 45%. And it’s not just oil. Qatar has signed a 27-year deal to supply China with gas . If this spreads to Saudi Arabia, that may have major economic and geopolitical consequences.

In sum, the Global South have grown up and want a place in the sun. Some among them ask why, having so many resources, they remain poor; still others see no reason why India and Brazil, each with populations larger than France and Great Britain combined, should not replace them in the Council.

Defending the Dollar

Two conflicting scenarios concerning the fate of the dollar come to mind. Case 1 assumes that the U.S. will stay the course and inevitably win another spectacular victory. Russia will be defeated in Ukraine and explode into a number of impotent polities; the BRICS challenge to the dollar will come to a screeching halt, and China and Iran will automatically be permanently tamed.

Conversely, Case 2 assumes that despite the U.S. and NATO’s best efforts, Russia will have its way in Ukraine and that BRICS will mushroom into a multitude of countries at least as numerous as – and wealthier – than the U.S. and its allies. The consequences, impossible to predict at this point, could range from a relatively innocuous loss of prestige to a complete collapse of the Western economy.

Critical Issues

It is no exaggeration to say that the dysfunctional quasi-bipolar Congress has been unable or unwilling, or both, to deal with these and other critical issues. The 2023 Financial Report of the U.S. Government states, in part:

• The Statement of Long-Term Fiscal Projections (SLTFP) shows that the present value (PV) of total noninterest spending, over the next 75 years, under current policy, is projected to exceed the PV of total receipts by $73.2 trillion.

• The debt-to-GDP ratio was approximately 97 percent at the end of FY 2023. Under current policy and based on this report’s assumptions, it is projected to reach 531 percent by 2098. The projected continuous rise of the debt-to-GDP ratio indicates that current policy is unsustainable.

• The Statement of Social Insurance (SOSI) shows that the PV of the government’s expenditures for Social Security and Medicare Parts A, B and D, and other social insurance programs over 75 years is projected to exceed social insurance revenues by about $78.4 trillion, a $2.5 trillion increase over 2022 social insurance projections.

• Interest costs related to federal debt securities held by the public increased by $181.5 billion due largely to increases in outstanding debt held by the public and the average interest rates, which were offset by a decrease in inflation adjustments.

• Many commodities, including oil and gold, are priced in US dollars. Therefore, should the dollar be deprived of its reserve status, the market would face increased volatility. As a result, commodity-exporting countries might seek new currencies. That would accelerate the dollar’s downward spiral.

• The de-dollarization drive currently under way could lead to a collapse of the dollar. If it does, imports would become more expensive and the government would be unable to borrow at current rates. In turn, that would result in a deficit that would need to be filled by increasing taxes or printing money, or both; inflation would skyrocket, and the economy would collapse.

• A 2023 Redfin analysis found that, due primarily to a low supply, only 16% of homes for sale were affordable for a typical U.S. household, the lowest in at least decade. A home is considered affordable if the estimated mortgage payment is no more than 30% of the average monthly income. In addition, White households could afford far more listings than Hispanic – and especially – Black households, who’ve faced decades of housing discrimination. In fact, only 7% of listings were affordable for a typical Black household. The U.S. has not built enough new homes since 2008. That has created a deficit of millions of units that pushed up not only home prices but also rents. The gap in affordability is much worse for the lowest-income households. This shortage is also the main driver of record U.S. homelessness rates. In fact, the Biden administration reported that more than 650,000 people slept outside or in shelters on a single night in January 2023, up 12% from the year before.

• The United States has greater wealth inequality than any other major developed nation, and Federal Reserve data show that the richest 1% of the population now own 54% of stock and mutual funds.

• At the other end of the wealth spectrum, a Bankrate survey revealed that 36% of U.S. adults have more credit card debt than emergency savings; only 44% would pay an emergency expense of $1,000 or more from savings; 21% would finance with a credit card and pay it off over time, 10% would borrow from family or friends, and 4% would take out a personal loan.

• Artificial intelligence will affect almost 40% of jobs around the world. Among the worst afflicted in the U.S. will be self-employed people who have spent most of their working years in at-risk specialized fields such as loan and real estate agents, appraisers, insurance agents, web developers and others tasked with getting and analyzing information. They will be disproportionately impacted because, unlike regular employees, they usually do not qualify for state-funded unemployment insurance to mitigate their plight. Clearly, a new mechanism such as Universal Avatar Income needs to be created to make sure they do not fall into the abyss of desperate activities detrimental to society or themselves.

In a sudden and completely de-dollarized environment dollar-denominated assets would lose much, if not all, of their value; the 1% of the population, who own most of the assets, stand to lose the most. However, even the homeless would be affected since whatever government-funded safety net support they may have been receiving would probably stop. Therefore, it is absolutely imperative to develop a feasible fallback plan to deal with Case 2 while we still can.

Swept Under the Rug

Despite the upcoming presidential and congressional elections in November 2024, neither the candidates nor the mainstream media have acknowledged and debated these issues. Instead, they distract the electorate with other themes such as abortion, crime and immigration, which, while important, do not threaten to collapse the national economy. Their silence is not difficult to understand. Insolvency is possibly decades away, and by that time they’ll most likely be out of office or dead; and they don’t appear to care much about their progeny, who will surely have to face the music.

Some mainstream media editorials and opinions on both sides of the propaganda divide commonly cite numberless allegedly evil deeds and demonize their respective heads of state. Although there may in fact be some truth to it, their tone and demeanor are primarily intended to provoke public outrage and to increase advertising revenue. But words are cheap; they’ve yet to suggest a realistic, comprehensive and feasible plan to prevent insolvency.

Caveats

Case 2 assumes that however gloomy things may appear to be, the highest priority of today’s decision makers should be to avoid annihilation. Therefore we the people must ensure that their successors will be amply endowed with incorruptible strength and unsurmountable leadership skills as they inevitably confront the intertwining interests of the fossil fuels industry, the financial system and the military-industrial complex; we must acknowledge and accept that the transition to hydrogen would be extraordinarily expensive but far less so than preserving the status quo. We’ll also be called upon to recognize that it would require a hitherto unprecedented level of cooperation, not confrontation, among the richest people and nations of the world; and crucially, that it will take time before the benefits start being felt.

Purpose of Case 2

The overriding goal of Case 2 is to ensure that, going forward, the U.S. dollar will perpetually remain just as acceptable domestically and worldwide as it’s been since 1945; by the same token, all other currencies would be just as acceptable because they would all be backed by green hydrogen. While this would end America’s habit of leveling sanctions on others at its discretion, it would also prevent anyone else from doing the same thing in the future. That would inject a much-needed transfusion of trust and stability to the global financial system, essential for global prosperity. Other related goals include a radical reduction in inequality; mass-construction of affordable single-family homes for Hispanics and Blacks, who lag far behind in terms of homeownership rates, and for the poor; creation of a new source of water to replenish aquifers and replace shrinking glaciers where desalination is impossible or prohibitive; construction of a nationwide state-of-the-art high-speed railroad network and a nationwide electric grid; boost agricultural output; and greatly increase the gross national product in the arid underpopulated western half of the U.S..

An Equalizer Formula

One way to prepare for Case 2 is to agree to create, and gradually usher in, a new formula to permanently determine floating exchange rates for all currencies. The formula would primarily be based on per capita production of green hydrogen from electrolysis of seawater and consider weighted factors such as deficit spending, trade imbalances, domestic inflation, and inequality rates. This would not infringe on anyone’s sovereignty because national governments would still retain domestic authority to set fiscal policies and to determine how much green hydrogen each country would produce. However, the formula would inherently impose disciplinary constraints on all nations equally, on pain of possible negative currency fluctuations, to deter attempts to overspend in an effort to achieve unearned preeminence. In effect, this would incentivize everyone to settle international disputes, no matter how intractable, by negotiation.

Enter Hydrogen

Unlike gold, silver, and other finite commodities that have since time immemorial been the cause of innumerable wars, no one in fact owns the rights to hydrogen in the ocean and, compared with fossil fuels whose extraction processes damage the environment, it is readily, quickly and easily available. Furthermore, sunlight, which would in this case be the source of energy used to produce it, is also free, universally available, and virtually inexhaustible. Hydrogen is the ultimate pollution-free energy carrier and it has the unique ability to create pure water when it is burned. Therefore, if used to generate electricity in deserts and semi-arid areas where glaciers, rivers and aquifers are shrinking, or where desalination is impossible or prohibitively expensive, that byproduct – water – could be collected, condensed, and used as a secondary source of energy to generate still more electricity. No other source of energy has this attribute. What’s more, the technology to make it real already exists. That includes at least one 100% efficient water splitter, anti-corrosive materials to transport it via pipelines or tankers, and at least one turbine capable of burning hydrogen directly 24 hours, 7 days a week without enzymes or fuel cells. The only thing lacking is an overarching economic incentive capable of weaning the world from its self-induced addiction to fossil fuels. The Hydrogen Equalization Formula might be that incentive.

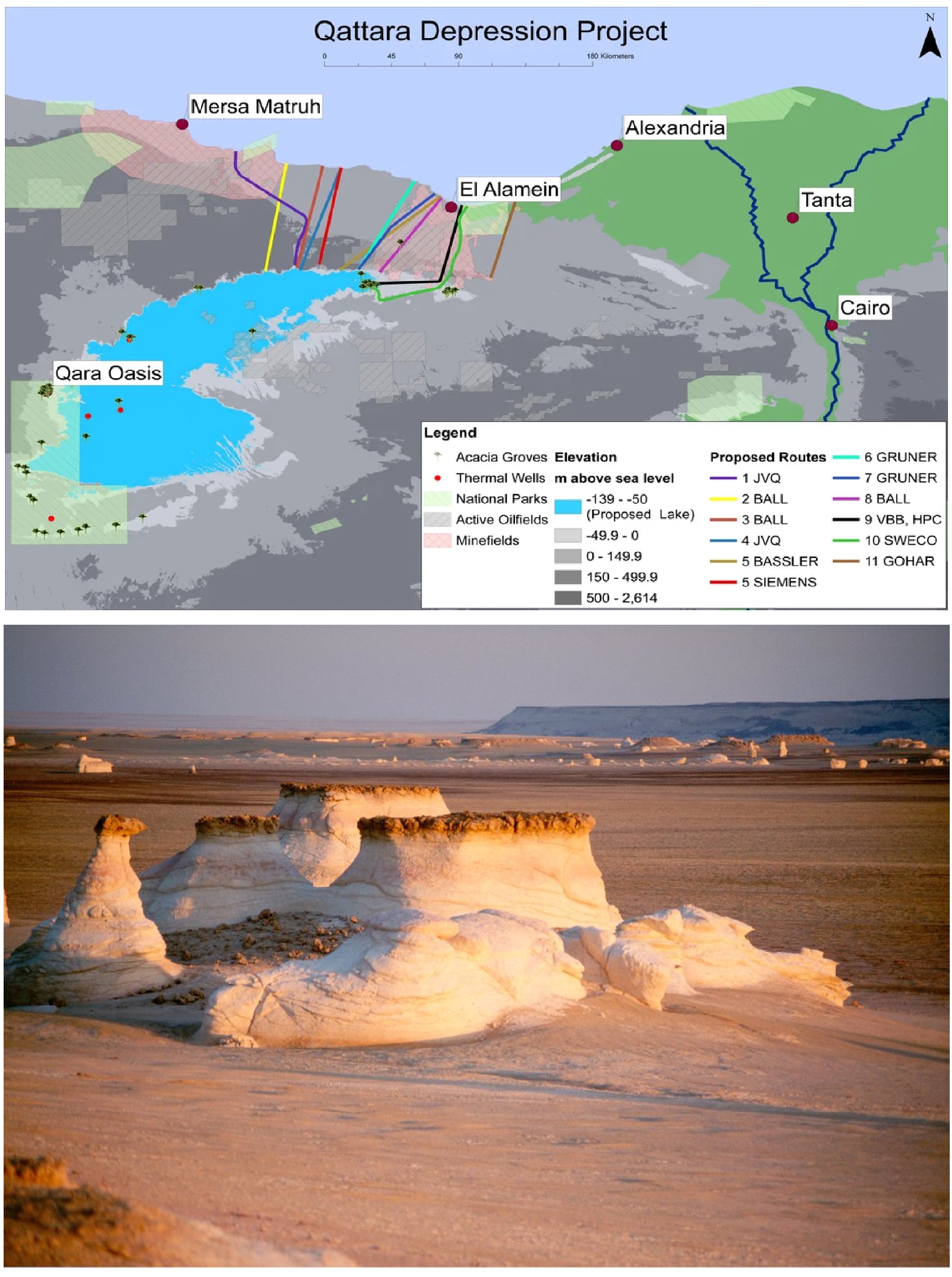

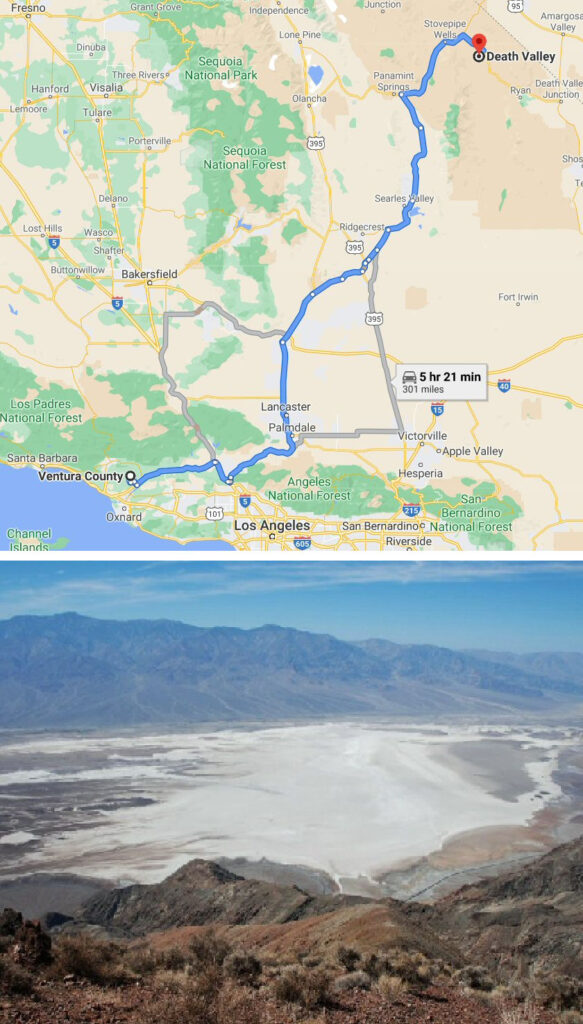

Landlocked nations such as Afghanistan, Central African Republic and Bolivia, or with limited sunshine and warm tropical waters, including Russia and Canada – could partner with others that do have these resources such as the Philippines, to create vast green hydrogen-producing plants. Egypt could flood the Qattara Depression with Mediterranean water, and Israel and Jordan could do the same to the Dead Sea with water from the Gulf of Aqaba to create green hydrogen hubs. Other promising locations are Namibia, the Atacama Desert, the San Julián Depression in Argentina, and of course, Death Valley in California could become a gateway to a vast hydrogen-producing hub intended to supply not just all of the U.S. but overseas markets as well.

As noted, the Equalizer Formula forcefully encourages all nations to either restrain expenditures or increase the production of green hydrogen, or both. One additional purpose of this built-in discipline is to prevent uncontrolled insolvency. Hydrogen in the ocean is recyclable and practically unlimited; therefore theoretically there’s no ceiling of how much of it could be produced.

How it Could Work in the U.S.

The first order of business is to substantially reduce the perennial deficits and the accumulated debt relative to the nominal GDP. Since that is presently impossible, the way forward is to increase the GDP by creating an entirely new hydrogen-based economy in the sparsely populated American West. One important reason for the 23.6% disparity in GDP between the western and eastern states is scarce western water. It therefore follows that the GDP of the West could potentially match the East if only it had as much. Accordingly, if hydrogen-burning plants built on strategic Western mountaintops were to generate all the electricity in the U.S., enough new water might be created to irrigate vast fallow lands, replenish stressed aquifers, and create a vibrant new hydrogen-based economy. The source of hydrogen would be Death Valley, the lowest point in North America. A sea-level canal from the Pacific, wide and deep enough to accommodate two supertankers simultaneously going in opposite directions, would be carved to keep Death Valley perpetually full by gravity. The hydrogen would be distributed nationwide by pipeline and also exported overseas by ship to China, India, Japan, the Koreas, and Europe, among many others. That might potentially either reduce or even eliminate the trade deficit, and millions of jobs that cannot be outsourced in construction, tourism, water leisure, energy-intensive industries such as aluminum and steel would be created.

The consequent combined increase in revenue and reduction in safety-net expenditures should help the government balance the budget, essential to support the dollar’s exchange rate as determined by the Equalizer Formula. In addition, as part of parallel negotiations with BRICS, who would be promoted from adversaries to each other’s customers, it might then become feasible to reduce defense expenditures.

Financing

It is possible to finance the transition to green hydrogen with private capital. Not only would the proposed system seek to usher in a green hydrogen economy without fossil fuels, it would create water and jobs where there aren’t any. In addition, it would simultaneously and gradually halt, and hopefully reverse, the trend to intolerable inequality, finance mass-construction of affordable single-family homes for everyone, including the very poor, and preempt possible future famines. To help finance the mass construction of single family homes, the system could also reorganize the energy-real estate relationship: homes and other buildings, not traditional utilities, would generate the lion’s share of the nation’s electricity; in that case cooperatives of homeowners, not shareholders of corporations, would receive the profits from the sale of electricity, water and hydrogen to help amortize any outstanding mortgages.

Epilogue

So, there it is. The plan should be thoroughly dissected by independent experts, and if it’s found to be rational, potentially profitable, feasible and environmentally friendly, then perhaps it’s high time for the presidential candidates to debate it publicly and give specific detailed reasons for their support or rejection.